In 2025, strategy is execution speed. Execution speed depends on visibility. The companies winning today aren’t smarter — they’re faster. They intercept market signals in hours, not quarters. They adjust pricing, positioning, and product before you even spot the change. That’s Competitive Intelligence. And if it’s not built into your system, you’re already a quarter behind.

“Today’s strategists must be able to anticipate, detect, and decipher signals of potential disruptions, which may be weak but can materialize fast.”

— Navigating the Future with Strategic Foresight, BCG, January 14, 2025

Note : In this article, CI refers to Competitive Intelligence , not Continuous Integration (commonly used in software development contexts).

Competitive Intelligence Data Analysis: Overview for Real-Time Strategy

Competitive intelligence analysis reduces decision latency by turning live market signals into structured outputs that teams can act on while the timing advantage still exists—not weeks later in a static report.

In 2025, product rollouts, price shifts, and market entries move in hours, not quarters. If your workflow still ends in quarterly PDFs, scattered spreadsheets, or reactive syncs, you are not doing competitive intelligence—you are documenting the past.

Note: In this article, CI refers to Competitive Intelligence, not Continuous Integration.

The GroupBWT CI Operating Model

Most teams confuse collection with analysis. Scraping pages, reading news, or tracking a few competitors does not create competitive readiness. Competitive intelligence and analysis only works when it closes the loop from signal to decision.

We use a four-step model to make CI actionable:

- Signal Capture (what changed)

Detect changes that matter: pricing, packaging, feature releases, messaging, partnerships, regional moves. - Context Validation (why it changed)

Confirm the change is real (not noise), identify scope (region, segment), and attach business meaning. - Decision Routing (who must act)

Convert inputs into role-specific outputs: alerts, battlecards, risk summaries, roadmap prompts. - Outcome Audit (did it move results)

Track whether teams acted in time and whether the response improved win rate, conversion, or roadmap accuracy.

If any step is missing, CI becomes a backlog of links instead of an execution tool.

What “good” looks like by team

Competitive intelligence data analysis creates value only when it matches how decisions are made:

- Product: catch feature direction early enough to reprioritize roadmap work before customer expectations shift.

- Marketing: detect positioning shifts and campaign themes before your messaging becomes “me too.”

- Sales & Leadership: deliver updated battlecards and live countermoves that reflect current pricing and packaging.

Boundaries and failure modes to avoid

Competitive intelligence fails in predictable ways:

- Over-collection: tracking everything increases noise and slows response.

- Unscored signals: without weighting, teams treat minor changes like major threats.

- No routing logic: insights land in one place, while decisions happen elsewhere.

- No audit trail: teams cannot trust outputs if they cannot trace source, timestamp, and context.

CI Readiness Checklist (10 questions)

Use this to pressure-test whether your CI works as a system:

- Do we define decision latency targets (hours/days) per team?

- Do we track 5–7 priority signals per team (not “everything”)?

- Can we tell what changed and why it matters in one sentence?

- Do we score signals by urgency, scope, and impact?

- Do we have role-specific outputs (alerts, battlecards, risk summaries)?

- Is routing integrated into real workflows (planning, pipeline reviews, exec updates)?

- Can any insight be traced to source + timestamp + context?

- Do we have a feedback loop to refine signals that teams ignore?

- Do we review signal quality and routing delays quarterly?

- Can we tie CI to outcomes (roadmap changes, win rate, conversion lift)?

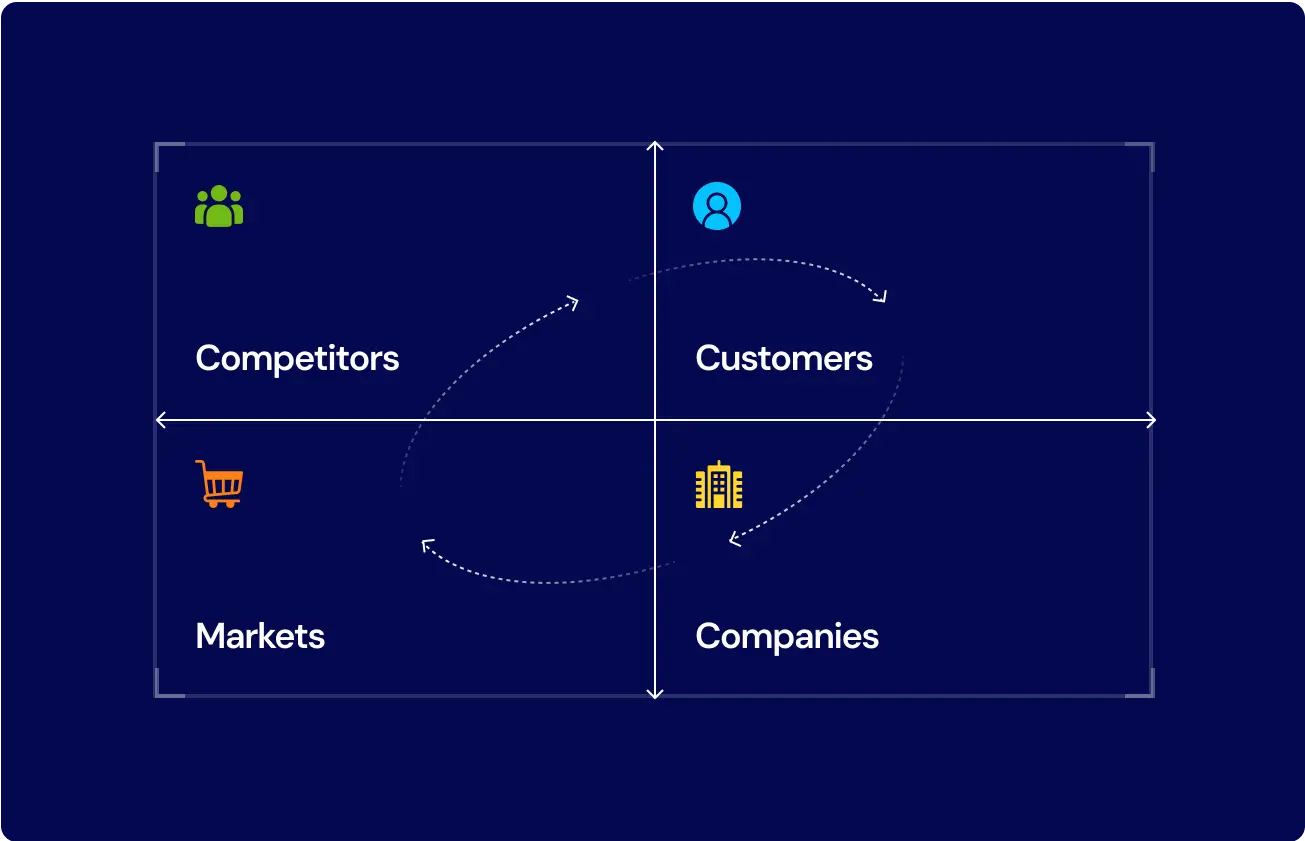

How Competitive Intelligence Supports Teams

Competitive intelligence only drives impact when it’s operationalized by specific teams. It’s not a single dashboard or a one-off report—it’s a system of inputs, filters, and outputs tailored to how decisions are made at the edge of product, marketing, sales, and strategy.

“Even teams with strong in-house tools face failures—vanishing listings, broken layouts, misaligned pricing—because the expertise to catch these shifts in real time is missing. We step in as integrators, embedding extraction logic directly into the systems and workflows where decisions are made.”

— Oleg Boyko, COO, GroupBWT

This section shows how competitive intelligence is used in practice and what happens when the system fails to reach the people who need it most.

Product Teams: Roadmaps Shaped by Real Shifts

Product managers rely on timing. To maintain a strategic advantage, they must spot:

- Feature releases from rivals

- UI and onboarding changes

- Performance claims in marketing or customer reviews

With competitive intelligence data analysis integrated into weekly planning, product teams can shift priorities before the market reactions. Without it, roadmaps become reactive and misaligned.

Marketing Teams: Positioning, Messaging, Timing

CMOs and growth leaders need to understand how their offer lands relative to others in the same space. That means watching:

- Competitor messaging updates across ads, blogs, and social media

- Campaign launch timing and themes

- Partnerships or endorsements that change credibility dynamics

Competitive intelligence enables positioning not just as a statement, but as a live response to market noise.

Sales and Executive Leadership: Live Countermoves

Sales teams need actionable outputs, not generic briefs. That includes:

- Updated battlecards with pricing and feature changes

- Competitor churn triggers and discounting behavior

- Win/loss insights based on prospects

At the leadership level, CI feeds strategic foresight: M&A readiness, investor narratives, and market timing.

Done right, CI becomes a shared system of truth, not just a siloed research stream.

Competitive Intelligence Analysis and Data Sources

Competitive intelligence is only as good as the sources that feed it. Teams often rely on one or two public tools or internal spreadsheets—yet the real edge comes from building a multi-layered system that reflects actual market movement, not vanity metrics.

This section details how to structure competitive intelligence analysis and data sources into a scalable input pipeline that matches how real decisions are made.

Public, Open, and Surface-Level Signals

Public data remains fundamental. These inputs are widely available but need to be processed contextually:

- Company websites, changelogs, and release notes

- Pricing pages, blog announcements, and job postings

- Review sites and marketplaces (G2, Trustpilot, App Store)

- Press releases and analyst coverage

Used correctly, this layer supports timeline tracking and external messaging comparisons. Used alone, it results in shallow conclusions.

Behavioral, Product, and Usage-Based Inputs

For deeper competitive intelligence product analysis, teams must observe how competitors behave, both in product and in the market. This includes:

- UI/UX behavior through product walkthroughs and onboarding

- Speed of new feature rollouts across regions

- API calls, payload structures, and public performance indicators

- Churn patterns are seen in customer reviews or pricing shifts

These signals are often overlooked, yet they’re essential for understanding the intent.

Technical, Legal, and Commercial Metadata

The strongest intelligence systems include metadata layers that detect broader shifts:

- Terms of service or SLA changes

- Partner directory updates

- Certificate renewals and platform integrations

- Legal disclaimers and licensing models

When analyzed in sequence, these signals uncover strategic pivots before they’re announced.

Competitive intelligence analysis and data sources should be prioritized by decision impact, not availability. The most valuable insights often come from low-visibility sources that require targeted extraction.

Data Aggregation for Competitive Intelligence

Collecting intelligence is only the starting point. The real challenge is turning raw, multi-format inputs into structured, decision-ready outputs. This requires aggregation at scale, across roles, and in near-real time.

Data aggregation for competitive intelligence means more than storing links or tagging screenshots. It’s the process of merging fragmented data into a unified, queryable layer that supports product, marketing, and executive functions simultaneously.

Understanding what is data aggregation in competitive intelligence helps clarify why this function is core, not optional.

Fragmented Inputs Break Down Fast

Without aggregation, teams operate from:

- Multiple unconnected instruments

- Manual spreadsheet updates/li>

- Delays between signal collection and decision-making

- Redundant or contradictory reports across departments

This creates version confusion, priority drift, and risk exposure in high-stakes markets.

Aggregation Adds Structure, Filters, and Relevance

Effective CI aggregation systems normalize inputs into role-specific structures:

- Tagging events by competitor, market, or feature

- Linking changes to product categories or pricing impact

- Routing alerts by team function and decision urgency

- Archiving signals with traceable timestamps and context

This removes noise and allows every team to focus on what matters to their scope of action.

Automation Makes Aggregation Scalable

Manual collection breaks under pressure. Leading teams use:

- Custom scrapers for source-specific data

- NLP-based labeling for context (eg, pricing vs. feature vs. positioning)

- CI dashboards segmented by region, product line, or persona

- Alert thresholds and weekly summaries to control attention bandwidth

The goal of data aggregation for competitive intelligence is clarity. The signal-to-noise ratio must improve with scale, not degrade.

“The real frontier isn’t AI or the Cloud—it’s data truth. I architect platforms and lead teams to convert high-volume, fragmented web reality into a single, reliable source of insight that drives market-defining growth.”

— Alex Yudin, Head of Data Engineering, GroupBWT

Techniques to Turn Competitive Intelligence Analysis and Data Sources Into Action

Collecting and aggregating intelligence is not enough unless paired with analytical methods that detect real change, evaluate risk, and enable direct action. Without structured interpretation, even high-quality data becomes a distraction.

This section focuses on competitive intelligence analysis techniques used by leading teams to turn observation into response.

Comparative Feature Mapping and Changelog Audits

Mapping feature sets across competitors—over time—reveals much more than launch announcements. By creating a rolling view of:

- What changes are being made

- How often do they occur

- Which segments or geographies are targeted

Teams can understand both product direction and strategic bets. Change frequency also signals development velocity and priorities.

How We Detect Positioning Shifts

Subtle shifts in messaging often precede hard changes in product or pricing. Teams use:

- NLP models to track tone or descriptor changes

- Entity recognition to monitor themes in blog posts or press releases

- Side-by-side campaign comparisons to flag audience pivots

These competitive intelligence data analysis techniques surface intent before features go live.

Signal Weighting and Strategic Categorization

Not all inputs are equal. Aggregated CI must be scored for:

- Urgency (immediate vs. long-term)

- Scope (localized vs. global)

- Impact (price, product, perception, partnership)

This is where competitive analysis intelligence becomes a formal practice. With structured weightings and decision thresholds, teams reduce noise and focus only on signals with measurable implications.

Building a CI System: Process and Tools

High-quality inputs and strong analysis are not enough if they’re not built into a sustainable system. Competitive intelligence fails when it’s treated as a one-off project or a personal responsibility of a single strategist.

This section outlines the competitive intelligence process and tools for intelligence analysis that allow data, workflows, and insights to scale with the organization.

Define Roles, Scope, and Reporting Logic

The process starts with defining the boundaries:

- Which competitors, products, and markets to monitor

- Which teams require CI outputs (product, sales, marketing, execs)

- What format and frequency fits their workflows (real-time alerts, weekly briefs, quarterly reviews)

This replaces scattered efforts with a repeatable competitive intelligence research analysis process.

Choose the Right Mix of Tools

No single platform can deliver end-to-end CI. Most companies blend:

- Web scraping tools and change trackers

- Internal CRMs and product analytics

- NLP models for language drift detection

- Visualization dashboards for timeline comparisons

The focus should be on stack fit, not tool popularity. Tools must support traceability, customization, and cross-role accessibility.

Operationalize Delivery and Feedback Loops

Insights are only useful if they are delivered on time and refined over time:

- Set alert thresholds to avoid noise

- Integrate with internal systems (Slack, Notion, Jira)

- Collect usage feedback from teams and adapt outputs

- Define CI KPIs and audit them quarterly

Competitive intelligence must be a shared responsibility—built into systems, not left to chance.

How to Collect Competitive Intelligence

A collection is not about tracking everything. It’s about setting up the right system to continuously monitor specific signals, extract them in a usable form, and route them to the right teams without delay.

Map the Intelligence Targets

Before building scrapers or sourcing tools, teams must define:

- Which competitors, markets, and categories to track

- Which signals map to product, pricing, positioning, or distribution

- How collection align with strategic goals and roadmap checkpoints

This is the foundation of how to collect competitive intelligence in a focused and role-specific way.

Set Collection Cadence and Source Logic

Collection strategies vary by data type:

- Product data: weekly or per-version checks

- Pricing data: daily or region-triggered

- Messaging data: NLP sweeps across content hubs and social media

- Legal or structural changes: monthly audits on TOS, partnerships, licenses

Automated pipelines should tag sources, timestamps, and changes for traceability.

Automate and Monitor Legally

Manual efforts cannot scale. But automation must respect jurisdictional boundaries. Teams need:

- Consent-aware scrapers

- Purpose-tagged datasets

- Source compliance logs

Knowing how to do competitive intelligence in regulated markets means collecting what’s relevant, legal, and verifiable.

Measuring Competitive Intelligence Impact

Once collection, aggregation, and analysis are in place, the real value of CI is proven not by volume, but by decisions made faster, with less guesswork, and more alignment. The challenge is not how to report data, but how to measure competitive intelligence as a function that improves business outcomes.

This final section closes the loop between signal and result.

Define Metrics by Function, Not Activity

Measurement must reflect outcomes per team. Example CI KPIs include:

- Product: percentage of roadmap reprioritized based on CI

- Sales: win rate in head-to-head competitor deals

- Marketing: CTR or conversion lift on counter-positioned campaigns

Activity volume (eg, number of briefs or scrapes) does not impact.

Link CI to Business Intelligence Outputs

To unify business intelligence and competitive analysis, CI must feed into:

- Executive dashboards

- Financial planning models

- Go-to-market simulations and forecasting tools

This is where CI shifts from research to operations. It becomes a measurable asset in enterprise systems.

Audit the Cycle and Improve Signal Quality

Measurement should include pipeline diagnostics:

- Which sources generated high-value responses

- Where delays occurred in routing intelligence

- Which teams acted, and where attention dropped

This feedback cycle ensures signal quality improves, not degrades, over time.

Stay Ahead of Competitors With Real-Time Market Signals

Manual tracking can’t keep up. Teams struggle to detect price shifts, new product launches, or regional promotions before the opportunity window closes. Traditional tools aren’t built for dynamic marketplaces.

GroupBWT builds custom competitive intelligence (CI) systems that extract real-time data from public sources—competitor sites, reviews, pricing feeds, and news aggregators. The result: legal, up-to-date, and role-specific insights that fuel strategy without extra labor.

If this sounds familiar, you’re not alone. Static dashboards and over-the-counter tools often miss what matters.

Replace Manual Monitoring With Smart Automation

Most teams waste hours compiling reports from screenshots, exports, or dashboards with week-old data.

Here’s how GroupBWT solves it:

- Custom scraping pipelines pull fresh data from competitors, SKUs, and regions

- Each scraper adapts to JavaScript, page logic, and structural changes

- Output feeds into BI-ready formats (JSON, CSV, API)

Outcome : Faster insights, fewer mistakes, and a direct feed into pricing, strategy, or growth planning.

Track Competitor Moves as They Happen

By the time your team sees a trend, the campaign window is often closed.

GroupBWT’s real-time CI systems:

- Scan for new product drops or stealth discounts

- Monitor reviews for language shifts and feature mentions

- Track regional price or stock changes under 24h

Result : Your team can respond to market triggers, not just trends.

Collect Data Legally, From the Right Sources

CI solutions must be legally compliant. Many vendors skip this.

Our systems:

- Follow data privacy rules per region (GDPR, CCPA, etc.)

- Use public, permissible sources—no login walls or private APIs

- Include audit-ready logs for every record

What this means : You can scale data use without exposing the business to legal risk.

Tailored CI Systems Built Around Your Team

Each company tracks different metrics. That’s why our solutions aren’t pre-built.

The process:

1. We scope your CI goals, risks, and team roles

2. We define what matters: SKUs, review terms, stock levels, etc.

3. We build modular scrapers and dashboards tailored to those flows

Outcome : No extra tools. No irrelevant data. Just a system that fits.

Optimize Continuously, Without Breaking Compliance

Once deployed, your CI pipeline adapts as markets evolve.

Our support covers:

- Daily uptime monitoring and alerting

- Rebuilds if page logic changes

- Ongoing compliance checks per jurisdiction

Result : A stable, future-ready CI system your team can trust.

Best Practices for Using Competitive Data

Here’s how leading companies extract more value from CI:

- Combine competitor and customer data to build a full context

- Use real-time feeds, not static dashboards

- Assign CI to a specific role (Ops, Pricing, Strategy)

- Validate compliance before scaling new sources

Bonus : Teams that follow these practices cut reaction time by 30–50%.

Why Companies Choose GroupBWT for Competitive Intelligence

We’re not a SaaS vendor. We’re a systems partner.

GroupBWT’s CI solutions:

- They are built from scratch per client, not templated

- Integrate cleanly with your tools (Metabase, Tableau, CRM, etc.)

- Come with full delivery logs, uptime SLAs, and support team access

How This Helped a Retail Ops Team Cut 2.5h/Day of Manual Work

“We used to track competitors with Google Sheets and screenshots. Now the system alerts us when key prices change. We get data we can use—without worrying about legal boundaries.”

— Head of Retail Strategy, anonymized European chain

Bottom line : We turn scattered data into usable, real-time strategy assets—built for legal, marketing, and C-level decision makers.

Get a tailored CI system scoped →

FAQ

-

What’s the difference between competitive intelligence and market research?

Market research is broad, static, and often outdated by the time it reaches decision-makers. Competitive intelligence is continuous, real-time, and directly connected to execution cycles. It enables companies to react to pricing, product, and positioning shifts before competitors gain ground.

-

Who inside the company should own competitive intelligence?

Competitive intelligence is not the responsibility of a single team. It must be embedded across product, marketing, sales, and executive leadership with tailored workflows for each. The true value lies in how quickly and precisely insights move between teams.

-

How often should competitive intelligence signals be updated?

Update frequency depends on the type of signal and its impact potential. Pricing and messaging data often require daily or weekly monitoring, while legal and structural inputs are typically reviewed monthly. The key is aligning update cycles with your most time-sensitive decisions and ensuring that data aggregation for competitive intelligence delivers relevant insights without delay.

-

Do I need a dedicated platform for competitive intelligence?

You don’t need one platform, but you do need a system. Competitive intelligence should combine targeted data extraction, contextual tagging, and filtered delivery across functions. The goal is operational fit, not tool count.

-

How long does it take to operationalize competitive intelligence?

A basic competitive intelligence framework can be set up within 2–4 weeks, with deeper integration unfolding over 6–12 weeks. Starting with 5–7 priority signals per team speeds adoption and results. Success depends on alignment, automation, and team readiness.