The Client Story

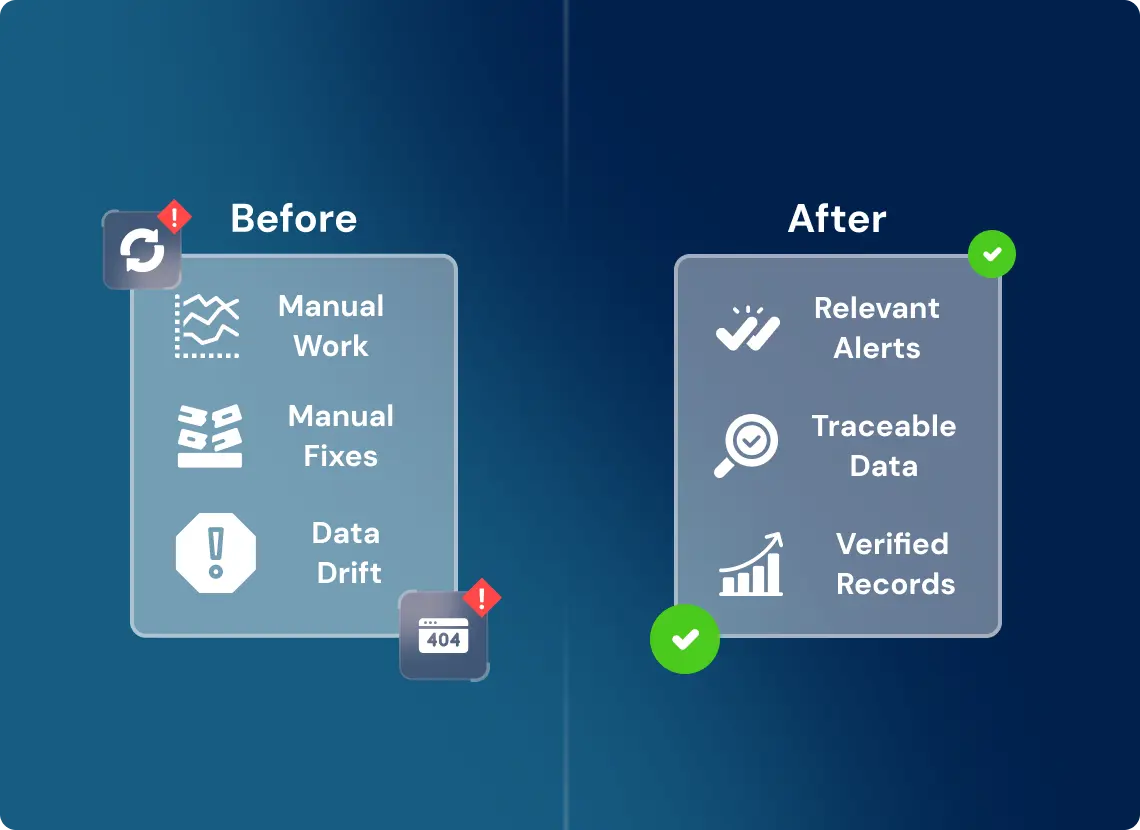

The client is a bank with 2M+ transactions daily, each containing memo fields with customer-supplied text. Their fraud review team relied on static keyword filters and legacy scoring rules to flag suspicious records, but these systems failed to detect pattern obfuscation, multilingual phrasing, or shell transfer tactics.

Risk teams were overwhelmed. False positives consumed analyst time; false negatives triggered fines. Alerts lacked audit traceability. Reviews lagged behind regulatory deadlines. They needed a scalable system to classify transaction narratives in real time, surface high-risk behavior before escalation, and explain model logic for internal teams and jurisdictional audits.

| Industry: | Banking & Finance |

|---|---|

| Cooperation: | Since 2022 |

| Location: | Global HQ – London, UK |

“Before this, we couldn’t explain alerts. Now we know why they trigger and prove every risk flag.” — Head of Global Risk Infrastructure

“We’re not reviewing noise. We’re reviewing the 1% that matters, in days, not weeks.” — VP, Compliance Strategy

Industry and Services

Check All СasesReal-time NLP for Transaction Narrative Parsing

Banking fraud teams often overlook the unstructured text inside transaction narratives. GroupBWT engineered a multilingual NLP pipeline that classifies 2M+ daily records in real-time, flagging anomalies, structuring risk-relevant verbs, and matching entries against historical fraud patterns. Each record was trained on semi-annotated data using custom embedding models derived from Suspicious Activity Reports (SARs) and their narrative patterns, then passed through a supervised classifier trained on real SAR filings and false-negative archives.

The pipeline normalized text across five languages and generated token-level logs for each classification decision. This eliminated blind spots in narrative-based fraud, accelerated review cycles, and brought risk workflows in line with cross-border compliance expectations.

Multilingual NLP Pipeline with Token-Level Audit Logging

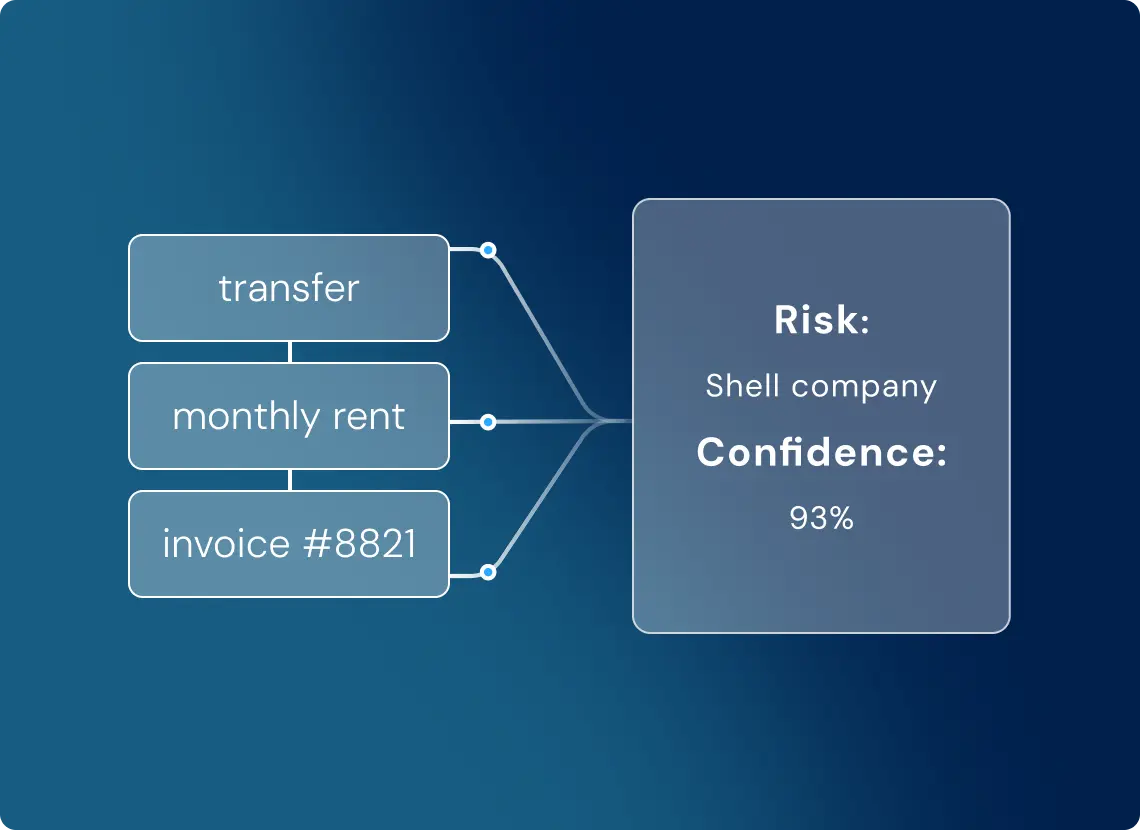

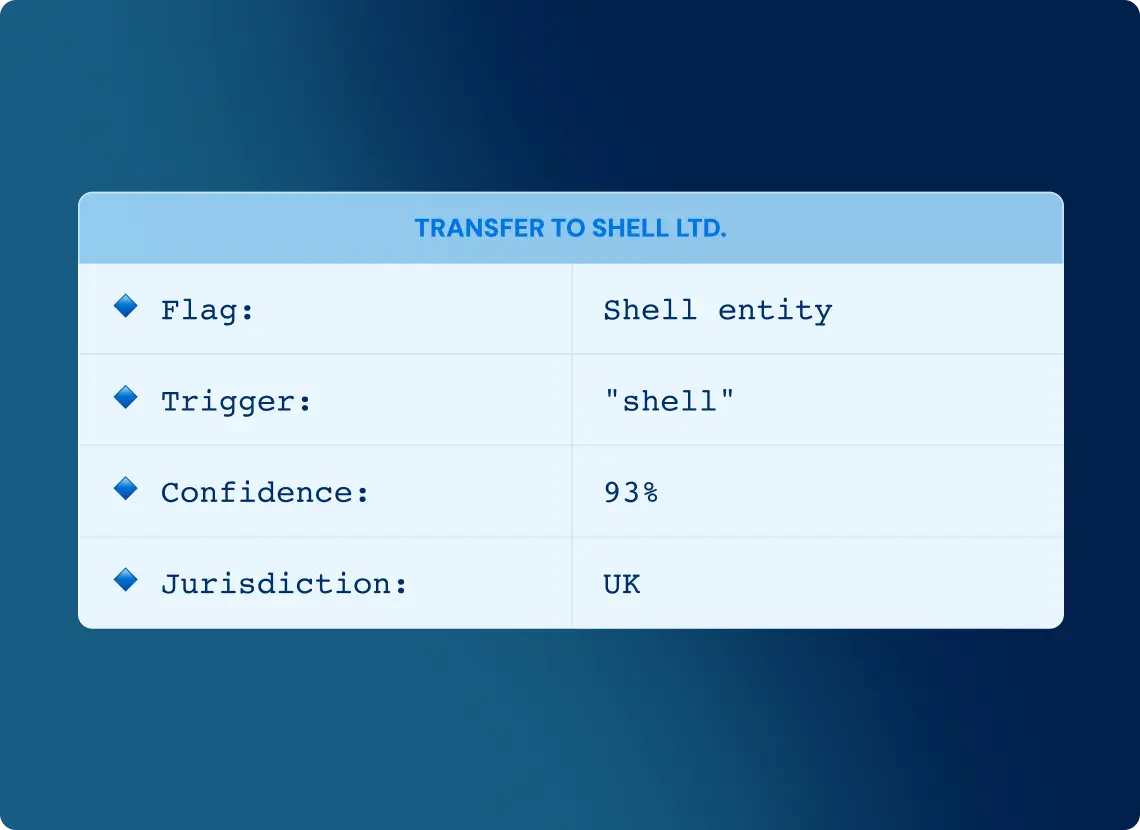

We deployed an enterprise-grade pipeline with modular NLP components. Raw narratives were ingested, preprocessed, and parsed into token sequences. We applied domain-specific NER to flag shell firms, verbs tied to illicit transactions, and memo fields mimicking legitimate transfers. Embedded transactions flowed through a pattern detection layer and were scored for deviation, recurrence, and semantic proximity. Flags triggered JSON logs that detailed exact token triggers, model confidence scores, and matching case precedents.

Components were containerized for isolation and governed by runtime limits to ensure performance and resource control. Each region’s compliance logic was handled through jurisdiction-aware routing and logging. Our solution leverages BERT-based embeddings, FastAPI for lightweight microservice deployment, and token-level logging built on Kubernetes.

The system wasn’t built for NLP alone. It was engineered to align audit logs with jurisdictional rules, trigger paths, and model justifications, down to the token. That’s what made this project not just fast, but admissible.

3× Risk Pattern Recall, 65% Faster Review Cycles

False positives dropped by 48%, while true positive rates tripled against the baseline. The average time required to manually review a single flagged transaction fell from 18.4 minutes to 7.2 minutes, allowing analysts to act faster without sacrificing audit traceability.

Analysts could now triage high-risk transactions by justification type, risk-indicating phrases, and deviation pattern. Audit logs included every risk match with full trace metadata. Jurisdictional compliance reviews passed without manual flag validation. Over 2 million transactions were processed daily without delay, across five languages and three fraud typologies. The NLP system was operational within 90 days and is now core to the client’s Tier-1 compliance stack for risk scoring, escalation, and regulatory reporting.

Ready to discuss your idea?

Our team of experts will find and implement the best eCommerce solution for your business. Drop us a line, and we will be back to you within 12 hours.

You have an idea?

We handle all the rest.

How can we help you?