The Client Story

A global consulting firm advised Fortune 500 manufacturers and luxury brands on pricing, positioning, and digital growth. Its multi-disciplinary structure includes distinct practice groups for Pricing & Strategy, VC/Private Equity advisory, and Luxury Brand consulting. Every recommendation, regardless of the division, relied on precise, continuous market intelligence.

The delivery team faced a fragile supply chain. Third-party data vendors and off-the-shelf tools failed to meet accuracy targets and collapsed under scale. Analysts spent hours validating flawed feeds instead of producing insights.

Building high-stakes strategies on poor data created structural risk. Without a stable pipeline, the firm’s ability to expand services and secure new clients was constrained.

| Industry: | Consulting |

|---|---|

| Cooperation: | 2025 |

| Location: | US |

“Our analysts spent more time validating data than analyzing it. That imbalance placed the client's strategy on a shaky foundation.” — Strategy Director, US Consulting Firm

“Client expectations shifted quickly. They no longer asked for static price checks. They needed scalable intelligence systems that supported growth.” — Senior Partner, US Consulting Firm

From Data Feeds to Strategic Assets

Executives demanded a shift: tactical data fixes were not enough. The firm needed reliable, high-frequency competitor tracking and the ability to build tailored platforms for complex client goals.

The system required enterprise-grade extraction infrastructure. It also required a partner capable of evolving into a co-developer of strategic assets. The challenge was about securing reliable continuity to protect revenue growth and manage risk.

Unified Platform and Service Expansion

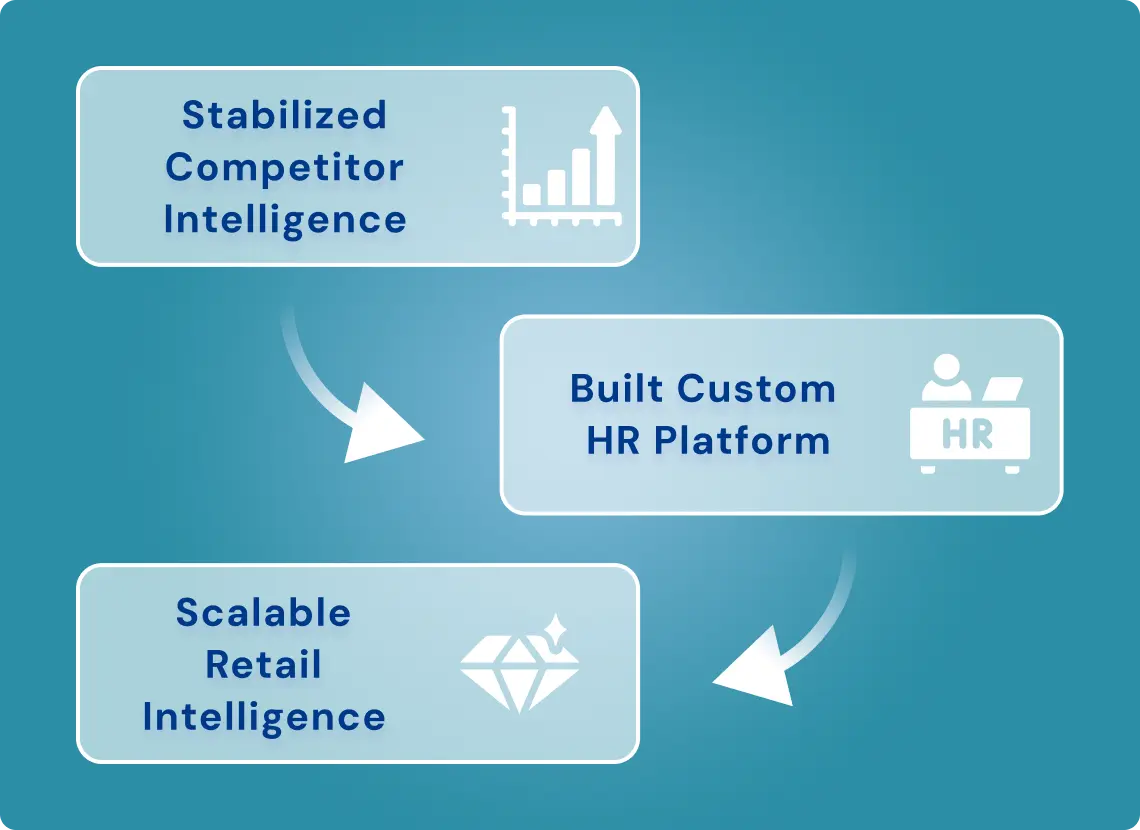

GroupBWT’s engineers structured the collaboration as a staged model, deepening the partnership and expanding service capabilities across the firm’s business units. This approach started by stabilizing the core competency: competitor intelligence. The team replaced fragile third-party feeds with precision Python scrapers built for the Pricing & Strategy Division. Structured JSON outputs flowed directly into PowerBI dashboards, while raw data assets were delivered to an enterprise data lake, eliminating reliance on volatile API access. This eliminated gaps in competitor price and stock reporting, establishing trust and delivering immediate ROI. Automation reclaimed 40 analyst hours per week for the pricing practice.

The initial success built the business case for wider technology enablement. The partnership transitioned from a data delivery mechanism to a co-developer of strategic assets, reducing operational risk across the firm. The firm later engaged the partnership for a complex challenge within their VC advisory practice. They needed to build a custom HR platform for a portfolio company handling bulk hiring requests with its 95k candidate base. GroupBWT delivered a full-cycle automated sourcing and engagement engine that unified candidate data and automated contact data collection with consent-based outreach. The agency’s candidate pool expanded from 95k to over 300k in six months, demonstrating the platform’s scalability beyond simple data delivery. This expansion dropped time-to-fill by ∼25%.

Engineers also successfully participated in a large-scale enterprise tender for the Luxury Brand consulting arm. The scope covered ongoing data collection from 600 websites across 12 markets with a strict delivery cycle. The project launched with a robust architecture combining advanced Python scripts and enterprise-grade data delivery mechanisms. The system met the 2–3 day SLA per category within the first delivery cycles. The platform established a repeatable model for luxury retail intelligence and reduced manual validation for the consulting team. Trust grew step by step. Reliability in feeds opened the door to solving harder accuracy problems.

A fragile data feed isn't a technical inconvenience; it's a direct threat to a firm's pricing power. Structural risk starts when validation consumes the analyst's day.

Unlocking Firm-Wide Efficiency and New Revenue

The partnership turned tactical fixes into a structural advantage. Initial automation reclaimed 40 analyst hours weekly. This resource shift allowed the Pricing & Strategy Division to focus on high-value analysis rather than constant data validation. The success of the custom HR platform opened a new, replicable service line for the PE/VC practice, delivering measurable recruiting gains for their portfolio companies. The candidate pool expansion from 95k to over 300k secured a demonstrable competitive edge for the portfolio client.

The technical rigor validated in the luxury retail proposal de-risked future large-scale client engagements. For the firm’s executives, the partnership provided a unified solution to a fragmented problem, delivering lower operating risk, higher client retention, and new sources of service revenue. Accuracy thresholds and validation safeguards reduced the firm’s exposure to critical data-related risk. The firm protected continuity under shifting client demands.

Takeaways

- Cut validation cost (Pricing Division): 40+ hours per week reclaimed through automation.

- Expand offerings (VC/PE Division): Custom HR platform created a new, scalable service line.

- De-risk strategy (Firm-Wide): Accuracy thresholds and validation safeguards reduced exposure to data-related risk.

- Prove enterprise scale (Luxury Division): Validated the technical ability to monitor 600+ domains with rapid, SLA-driven delivery.

- Protect continuity: A resilient, multi-stage partner model ensured scalable delivery under shifting client demands across the entire firm.

Ready to discuss your idea?

Our team of experts will find and implement the best eCommerce solution for your business. Drop us a line, and we will be back to you within 12 hours.

You have an idea?

We handle all the rest.

How can we help you?