The Client Story

The clients—three regional real estate agencies managing 50–300 active listings—operate in highly competitive urban markets where daily market visibility shapes both pricing strategy and closing speed.

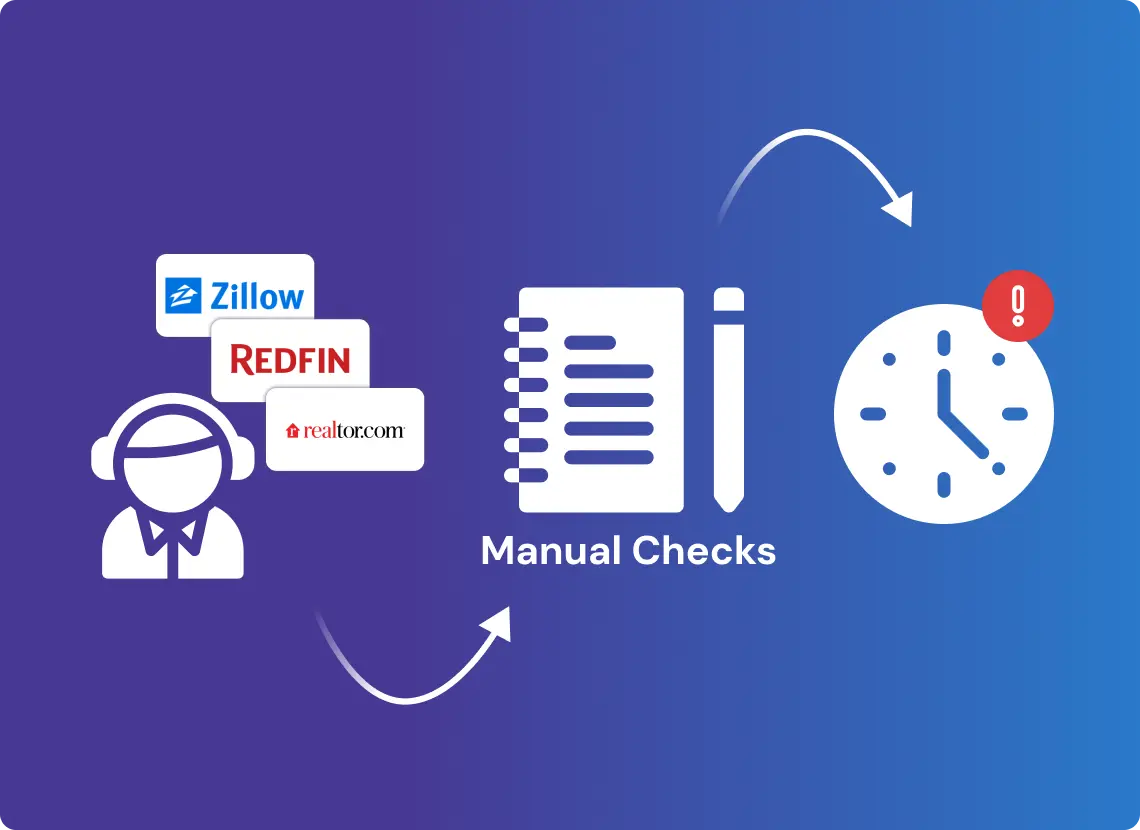

Before automation, agents spent hours reviewing Zillow, Realtor.com, and Redfin to track:

- Nearby listings with lower prices

- Delisted or expired competitor inventory

- Inventory spikes in key neighborhoods

This manual routine fragmented their workflow and relied on screenshots and unstructured notes. Sales teams often reacted too slowly, missing the opportunity to reposition listings in time.

| Industry: | Real Estate |

|---|---|

| Cooperation: | 2025 |

| Location: | USA |

“Our agents didn’t need more platforms—they needed clean signals tied to the listings they manage.” — Head of Strategy, LA Real Estate Group

We weren’t shopping for a dashboard. We wanted the right data delivered into our spreadsheets and CRMs—without disrupting our pipeline.” — Sales Ops Lead, Miami Real Estate Agency

Manual Monitoring Was Slowing US Sales Teams Down

Before automation, real estate teams spent hours each day scanning Zillow, Redfin, and Realtor.com. This slowed decision-making and drained time from selling activities.

Agents lacked:

- Timely alerts on competitor price drops

- Visibility into withdrawn or expired listings

- Clarity on inventory changes within high-demand ZIP codes

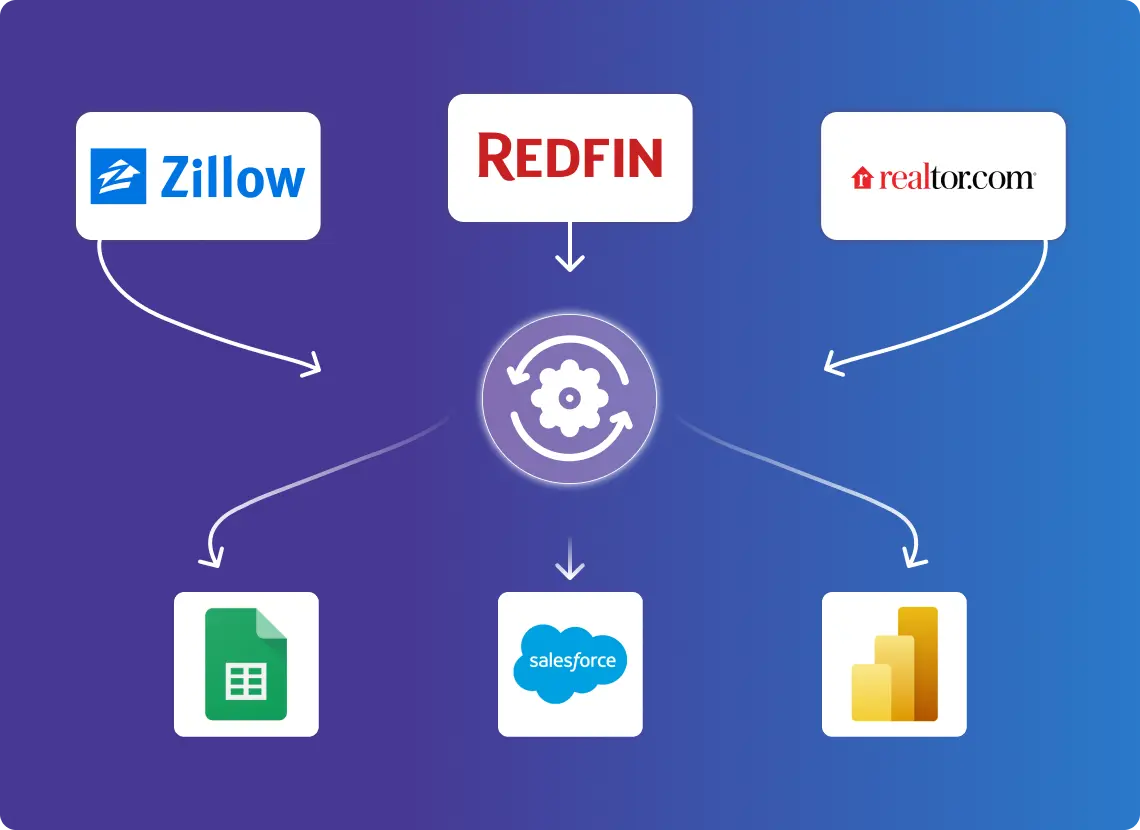

GroupBWT replaced this routine with a scraping-based system that tracked all three platforms daily. Each agency received real-time, structured feeds into their existing CRM or spreadsheet workflows—no retraining, no login switching.

Custom Listing Signals Delivered to Sales Workflows

Our team engineered scraping pipelines that:

- Crawled Zillow, Redfin, Realtor.com, and 20+ public real estate agency websites daily

- Filtered data by ZIP code, listing type, price threshold, and agent ID

- Tracked key changes like:

- Listing status: Active / withdrawn / expired

- Price movement with timestamped reduction history

- Agent visibility and contact metadata

- Submarket-level listing spikes

Our team engineered scraping pipelines that:

- CSV or Excel with change-tracked fields

- Optional dashboards in Power BI or Looker—built only if required, using client licenses

- Custom CRM integrations (e.g., Salesforce, HubSpot, Bitrix24), adapted per client system

Each signal was aligned to agents’ pricing processes—clean, structured, and reusable.

We built a market monitoring layer—not a product. It runs in the background like infrastructure: invisible, reliable, and fully tailored to how each team works.

From Reactive Guesswork to Evidence-Backed Pricing

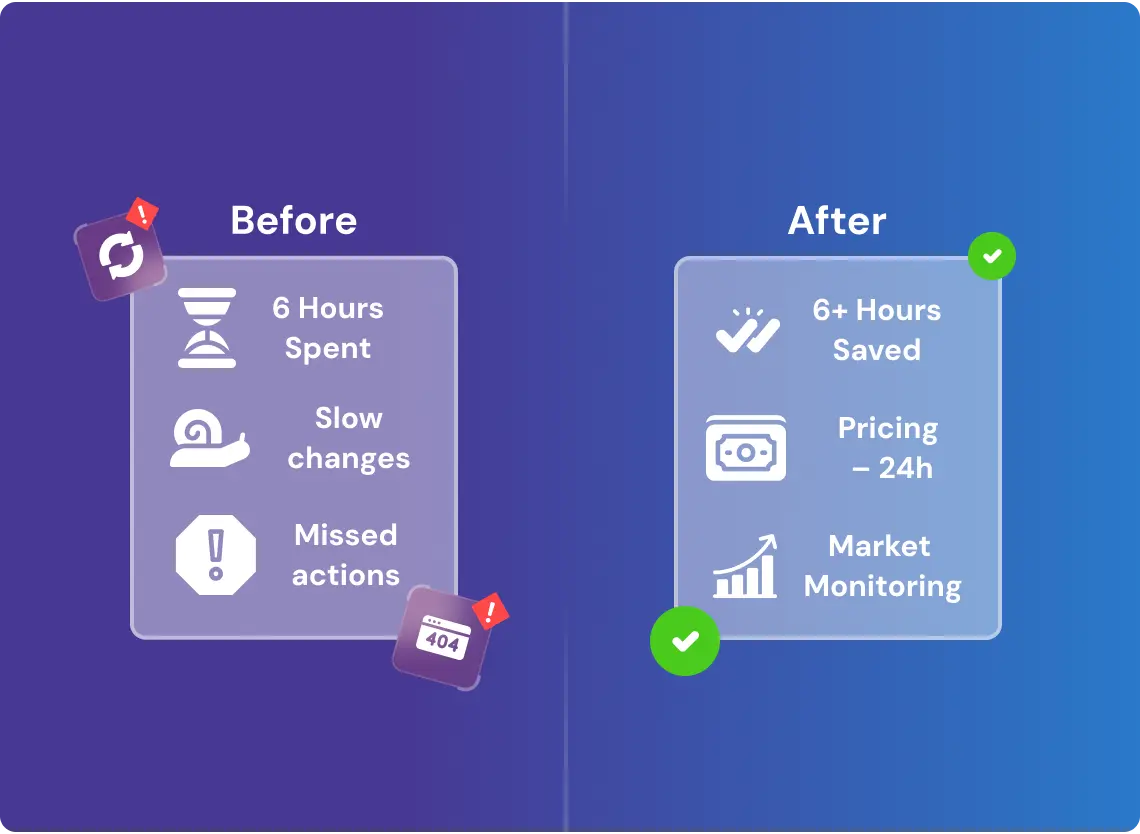

Before:

- Agents spent ~6 hours weekly checking listings

- Pricing changes lag by days

- Competitive moves were often missed

After:

- 6+ hours saved weekly per agent

- Repricing decisions accelerated to within 24 hours

- Competitor actions now flagged same-day

- Market volatility tracked at ZIP code and neighborhood levels

Each feed includes:

- Timestamp and version tracking

- Change diff per listing

- Direct listing URLs for source verification

Ready-to-Use Data, No Relearning Curve

GroupBWT delivers signal engines, not software—feeds that work inside your tools, your templates, and your workflows. Want to catch price drops, delistings, or inventory spikes before your competitors do? Let’s build the feed for that.

You have an idea?

We handle all the rest.

How can we help you?