Competitive analysis and benchmarking form the foundation of every strategic decision. Many companies depend on quarterly reports, manual tracking, and third-party market research. However, when analyzed, the data is already outdated.

The Business Intelligence (BI) market is thriving and is projected to reach $78.42 billion by 2032. Companies worldwide invest in real-time data for competitive intelligence to stay ahead.

Most businesses rely on outdated data, making slow, ineffective decisions. Competitive analysis and benchmarking are essential for tracking market shifts, optimizing pricing, and staying ahead. Cloud BI leads the market, with companies using web scraping and automated data collection for real-time insights.

This GroupBWT article outlines the best competitive intelligence strategies for 2025 and shows how web scraping and data-driven BI solutions give businesses an edge.

How to Analyze Market Positioning

Competitive analysis dissects the battlefield. It reveals power moves, blind spots, and vulnerabilities. Every company exists in a competitive ecosystem, either leading or losing ground. The winners analyze, adapt, and outmaneuver.

Every business wants an edge, but few achieve it. This is not because they lack ambition but because they lack insight. Competitive analysis clarifies who dominates, why they dominate, and how to break through.

Why Market Positioning Drives Strategy

Brands don’t compete in isolation; they exist in a dynamic, shifting arena where customer expectations evolve, new players emerge, and industry standards rise. Understanding the competitive landscape defines success.

Competitive benchmark analysis uncovers:

- Market gaps: Where competitors underperform, leaving space to seize opportunity.

- Consumer behavior shifts: Where preferences shift before the competition notices.

- Industry best practices: What leaders execute flawlessly to maintain dominance.

- Pricing, positioning, perception: The intersection of brand identity and market demand.

Every competitor has weaknesses. Some fail at customer retention, others struggle with operational efficiency, and many ignore innovation until it’s too late. The competitive analysis identifies these cracks and presents data-driven opportunities to disrupt.

Why Real-Time Data Beats Reports

Annual reports, static research, surface-level comparisons—outdated, ineffective, blindfolded strategy. Winning businesses use real-time data. They track:

- Competitor pricing adjustments in real-time.

- Shifting SEO strategies, backlinks, and content authority.

- Social sentiment trends before they go mainstream.

Web scraping automates competitive intelligence, turning fragmented data into strategic power. Benchmarking identifies emerging trends before the market reacts. This ability to capture and structure live data is the fundamental core of web scraping in data science workflows.

There are no outdated models—only real insights continuously refreshed, analyzed, and leveraged. The competitive benchmark is the difference between reactive survival and proactive dominance.

How to Benchmark Against Industry Leaders

Benchmarking reveals performance gaps, optimizes strategy, and ensures businesses don’t fall behind. The fastest-growing companies measure, compare, and improve relentlessly. They don’t guess. They track, analyze, and execute.

Transforming competitive intelligence with custom data aggregation tools explains how businesses can leverage automated data aggregation to streamline benchmarking and extract actionable insights in real-time. The complexity of unifying disparate inputs across competitors necessitates sophisticated platforms offering content aggregation services for normalization.

Competitive analysis examines external threats and opportunities. Benchmarking drives internal excellence by comparing performance against industry leaders. Together, they create a data-driven growth machine.

Benchmarking answers:

- Are we as efficient as the best in our industry?

- Where do we lag?

- What operational, financial, and customer experience standards must we meet?

Companies that fail to benchmark drift aimlessly. Their competitors move faster, optimize smarter, and dominate markets before they react. Meanwhile, those struggling to keep up waste time searching for solutions—often relying on generic strategies when they genuinely need a tailored approach.

What Are the 3 Benchmarking Types?

- Process Benchmarking: Improve Team Efficiency

Comparing performance across teams, departments, and locations. Identifies internal best practices. Uncovers inefficiencies. Increases productivity without increasing costs.

- Strategic Benchmarking: See Market Position Clearly

Measuring products, pricing, customer satisfaction, and brand perception against direct competitors. Exposes gaps. Reveals hidden advantages. Sharpens strategy.

- Performance Benchmarking: Learn from the Best

Smart businesses look beyond their industry, studying leaders in logistics, automation, and customer experience. They don’t imitate—they adapt, turning cross-industry insights into competitive advantage.

Which KPIs Matter for Benchmarking?

Benchmarking without data is guesswork disguised as strategy. Companies need clear KPIs to measure success.

Essential KPIs include:

- Operational KPIs (efficiency, production costs, delivery speed)

- Customer KPIs (retention rates, NPS, customer acquisition costs)

- Market KPIs (brand sentiment, share of voice, pricing competitiveness)

Businesses tracking real-time KPIs gain an unbeatable edge. Web scraping automates benchmarking—pulling competitor pricing, customer sentiment, and performance metrics faster, smarter, and effortlessly.

Benchmarking vs. Analysis: What’s the Difference?

Competitors shape the game, and industry leaders set the rules. Competitive analysis and benchmarking operate at different levels, but together, they define who wins, who follows, and who disappears.

Competitive analysis dissects rivals, threats, and opportunities. It maps strengths, weaknesses, and market positioning. It answers:

- Who are the most significant threats?

- Where do they outperform?

- What gaps can we exploit?

Benchmarking tracks the best. It identifies top industry performers, analyzes their systems, and sets performance targets beyond competition. It answers:

- What defines market leaders?

- What efficiency levels must we reach?

- How do we scale without blind spots?

Direct vs. Standard Benchmarks Explained

Some industries move too fast for traditional research. Market conditions shift, customer behaviors change, and pricing fluctuates. Competitor benchmark analysis combines both worlds—tracking real-time competitor shifts while maintaining industry-wide performance benchmarks.

Web scraping makes this scalable. Automating competitor tracking and benchmarking data collection allows businesses to pivot, react, and execute faster than the market. Speed wins, and precision dominates.

How to Benchmark Competitors Step-by-Step

Every industry has leaders, outliers, and those struggling to keep up. Competitive benchmarking analysis is the blueprint for market dominance, exposing inefficiencies, highlighting opportunities, and setting clear performance targets.

The best companies don’t guess—they measure, compare, optimize, and refine.

Step 1: Map Competitors by Type

Who defines the standard? Who threatens your market share? Competitive benchmarking begins by classifying competitors:

- Direct competitors: Businesses selling products/services to the same audience.

- Indirect competitors: Alternative solutions that satisfy the exact needs differently.

Failing to analyze both leaves leaves blind spots. Innovation often comes from outside your industry.

Step 2: Choose the Right Metrics

Benchmarks competitors’ analysis without measurable KPIs is directionless comparisons. Define critical metrics:

- Market Performance: Revenue, market share, customer retention.

- Operational Efficiency: Production costs, fulfillment speed, automation levels.

- Customer Sentiment: Reviews, engagement, net promoter score (NPS).

- Digital Presence: SEO rankings, content performance, paid ad efficiency.

Step 3: Automate Data Collection

Manual research is obsolete. Data ages fast. Real-time insights matter. To maintain velocity and data quality for these competitive feeds, organizations often outsource data extraction services to guarantee throughput.

Manual research is obsolete. Data ages fast. Real-time insights matter.

- Web scraping extracts competitor pricing, product updates, content strategies, and consumer sentiment at scale.

- Automated tracking monitors shifts in SEO, social engagement, and ad spending.

- AI-driven analysis identifies patterns, trends, and anomalies before they impact the market.

This strategic extraction of competitive intelligence is directly applicable to managing specialized data feeds, such as those required for real-time telecom research address projects.

Step 4: Turn Data into Action

Raw numbers mean nothing without execution. Find the gaps. Adapt faster than the competition.

- If competitors rank higher in search, refine your SEO & content strategy. Harnessing advanced analytical models is often key to achieving market dominance, leveraging the latest advancements in the best LLM for web scraping to interpret complex data patterns.

- If pricing fluctuates, automate real-time adjustments.

- If customer sentiment shifts, pivot messaging before they do.

Benchmarking is an evolving strategy. The best businesses don’t just compete; they predict, react, and lead.

Tools That Power Competitive Benchmarking

Every market leader tracks, analyzes, and optimizes with elite benchmarking competitor analysis tools. The right tools reveal market shifts, competitive gaps, and untapped opportunities—before anyone else notices.

Which Strategy Frameworks Actually Work?

- SWOT: Strengths, Weaknesses, and Gaps

- Strengths: What gives your business an edge?

- Weaknesses: Where are competitors outperforming?

- Opportunities: Market gaps, emerging trends, untapped audiences.

- Threats: Disruptors, pricing wars, new regulations.

SWOT cuts through the noise. It forces clarity, aligning internal strategy with external realities.

- Porter’s Forces: Map Your Market Power

Porter’s framework maps out:

- Competitive Rivalry: How intense is the fight for market share?

- Buyer Power: Can customers dictate pricing?

- Supplier Power: Who controls the supply chain?

- Threat of New Entrants: How easily can startups disrupt the space?

- Threat of Substitutes: Are alternatives stealing demand?

Use this to predict market shifts before competitors react.

Track Competitors with Real-Time Intelligence

- How Web Scraping Tracks Competitors

Static reports are dead. Real-time, automated tracking wins. Web scraping extracts:

- Competitor pricing strategies (adjust as they adjust).

- SEO dominance signals (track backlinks, keywords, ranking shifts).

- Product innovation cycles (monitor new releases, feature rollouts).

- Customer sentiment analysis (detect dissatisfaction before it trends).

- Why Custom BI Beats Off-the-Shelf Tools

Most businesses rely on off-the-shelf analytics tools, but they have limitations. They track only publicly available data and lack customization for industry-specific needs.

GroupBWT develops tailored, competitive intelligence solutions that go beyond standard SaaS products. Unlike traditional tools, our solutions:

- Collect real-time competitor insights without API restrictions. This capability is crucial for identifying market gaps, drawing on experience from data analysis for Beauty Industry applications.

- Extract hidden data points that general analytics tools miss.

- Integrate seamlessly with existing BI systems for deeper analysis.

Traditional tools provide surface-level tracking, but custom intelligence systems offer the precision and flexibility needed for market domination.

Tools don’t win markets. Execution does. The businesses that track, adapt, and move first set the standard. The rest will follow.

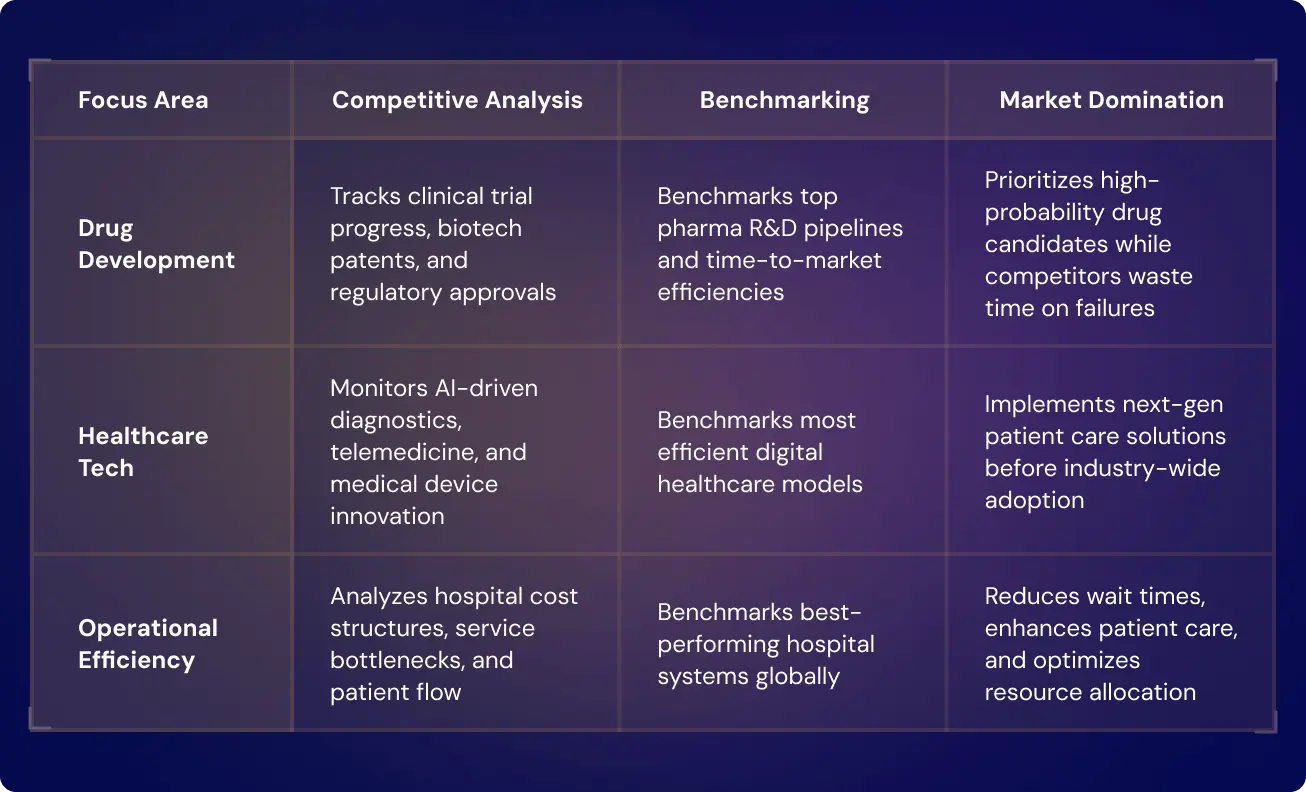

Industry Examples of Benchmarking in Use

Some industries compete. Others control the market. The difference? Data. Speed. Execution. Businesses that do competitor benchmarking analysis dominate. The ones that react struggle to keep up.

Traditional market research is dead before publication, and the data is outdated when reports circulate. Winners see trends before they happen, act before competitors react, and set the pace of change.

E-Commerce: Benchmark Pricing and Trends

E-commerce winners don’t just sell more—they sell first, at the right time, at the right price.

For e-commerce operations, continuous visibility across inventory and pricing is maintained through robust ecommerce website data scraping solutions.

Finance: Predict Risk with Benchmarks

Risk isn’t avoided in finance—it’s calculated, priced, and controlled. The firms that predict market movements before they happen don’t just survive—they win.

Healthcare: Benchmark R&D and Innovation

The future of healthcare isn’t just medicine—it’s data, automation, and predictive patient care. R&D cycles are shrinking. AI is accelerating drug discovery. Benchmarking isn’t optional—it’s the difference between market leadership and stagnation.

Manufacturing: Track Efficiency and Costs

Manufacturing is no longer about production speed—it’s about data-driven precision. AI optimizes supply chains, and automation is non-negotiable. The winners? They produce faster, cheaper, and with zero waste.

Cybersecurity: Benchmark Threat Readiness

Cybersecurity is a race against attackers. The slowest companies get breached. Competitors focus on reactive defense. Market leaders build AI-driven security that stops threats before they happen.

Apply Benchmarking in Your Business

Stop reacting—start predicting

- Track real-time competitor shifts, product launches, and pricing updates.

- Stay ahead with web scraping, AI-driven tracking, and automated alerts.

Innovate beyond your industry

- Benchmark across industries that are growing, not just direct competitors.

- Study customer engagement models, personalization tactics, and emerging trends outside your field.

Build unshakable brand loyalty

- Analyze how industry leaders create customer retention strategies.

- Develop an ecosystem strategy that locks customers in and increases lifetime value.

This extends to monitoring external reputation and pricing, demanding continuous vigilance via brand monitoring data scraping solutions.

Optimize pricing for maximum profitability.

- Benchmark against SaaS, e-commerce, and subscription models that master dynamic pricing.

- Test tiered pricing, regional adjustments, and behavior-based offers to maximize revenue.

Outperform competitors in marketing and engagement

- Dissect your competitors’ content strategy, ad spend, and SEO performance.

- Use competitive intelligence tools to refine your digital strategy.

The businesses that analyze, adapt, and execute benchmark competitor analysis faster than the market set the standard. The rest? They just try to keep up.

What Blocks Benchmarking—And How to Fix It

Markets shift, competitors move, and static strategies fail. Businesses struggle not because they lack ambition but because they lack real-time, structured intelligence.

1. Fixing Benchmarking with Better Data

The Problem:

- Competitor data is fragmented, outdated, and unreliable.

- Manual tracking is slow and prone to errors.

- Biased or self-reported data leads to flawed strategies.

How to Overcome It:

- Automate data collection with web scraping to extract real-time competitor intelligence—pricing, SEO shifts, product launches, customer sentiment, and ad trends.

- Cross-validate data across multiple sources to eliminate errors and inconsistencies.

- Ensure seamless integration into BI tools, ERP, or CRM systems for direct, actionable insights.

2. How to Avoid Data Overload in BI

The Problem:

- Businesses drown in data but struggle to extract meaningful insights.

- Traditional tools dump raw numbers instead of providing clear intelligence.

- Decision-makers waste time sorting through noise instead of acting.

This is why organizations need systems that go beyond raw collection, applying robotic process automation (RPA) services to automate the cleanup and routing of structured feeds.

How to Overcome It:

- Intelligent data aggregation filters out irrelevant data and prioritizes key metrics.

- AI-driven insights detect trends, anomalies, and competitor movements in real-time.

- Custom dashboards deliver actionable intelligence, eliminating manual processing.

3. How to Track Changes Before Competitors

The Problem:

- Pricing, SEO rankings, and consumer sentiment change rapidly, but most businesses react too late.

- Static benchmarking fails—what worked yesterday is obsolete today.

How to Overcome It:

- Dynamic benchmarking tracks live competitor pricing and SEO shifts to optimize strategy instantly.

- AI-driven sentiment analysis detects early market trends before competitors react.

- Automated tracking and alerts ensure pricing, content, and marketing strategies adjust quickly.

This integrated intelligence approach has proven success in managing complex data streams, similar to the demands of scraping for an e-commerce logistics provide for real-time cost optimization.

Build a Custom Competitive BI System

We don’t sell pre-built tools—we engineer custom web scraping and data mining services designed for your business needs. 15+ years of hands-on experience in competitive intelligence, data aggregation, and real-time tracking.

- Web Scraping Expertise: We extract, structure, and automate high-value data from competitors, markets, and customer trends. This expertise extends into highly valuable, unstructured sources, confirming the necessity of gaining insights from consumer reviews for product strategy.

- Seamless System Integration – Our solutions plug directly into your ERP, CRM, BI dashboards, or internal tools for direct execution.

- Scalable & High-Performance – Our systems scale with zero performance bottlenecks when tracking five competitors or an entire industry.

This scalability is crucial not only for e-commerce but also for human resources, leveraging proven approaches in data scraping for recruitment to map talent pools.

Let’s build your competitive advantage. Contact GroupBWT to develop a fully integrated, high-performance web scraping solution.

FAQ: Benchmarking and Competitive Analysis

-

Why Real-Time Beats Traditional Research?

Traditional market research relies on static reports and outdated data, which causes businesses to react too late to market shifts. Real-time competitive analysis, powered by web scraping and AI, delivers live insights. It tracks competitor pricing, SEO strategies, and customer sentiment as they evolve. This eliminates guesswork, ensures faster, data-driven decisions, and keeps companies ahead rather than playing catch-up. Speed wins. Stagnation kills.

-

How Scraping Boosts Benchmarking Accuracy?

Web scraping automates data collection across competitors, extracting pricing, SEO rankings, content strategies, and market trends at scale. Unlike manual tracking, it’s fast, precise, and cost-effective, enabling businesses to benchmark real-time performance against industry leaders. Companies leveraging web scraping don’t just analyze competition—they predict their next moves before they happen.

-

Biggest Mistakes in Competitor Analysis

The most common mistakes include:

- Relying on outdated reports and making decisions on stale data.

- Ignoring indirect competitors and missing market disruptors.

- Overanalyzing without action leads to decision paralysis.

- Focusing only on price rather than the entire customer experience.