Fleet managers, automotive retailers, and parts suppliers rely on real-time data from dozens of platforms. But fragmented sources, stale listings, and inconsistent part IDs make accurate decision-making difficult.

This GroupBWT guide breaks down how data extraction for automotive works—what systems power it, how risks are mitigated, and what business outcomes you can expect. Use this to scope your next data strategy.

What Is Data Extraction in Automotive—and Why It Matters

Modern automotive decision-making hinges not just on access to data, but on the right kind of access, at the right time, in the right format.

Whether you’re managing a fleet, operating a parts marketplace, or building machine learning models to predict vehicle demand, the data you need is often fragmented across various sources, including VIN lookup platforms, resale marketplaces, manufacturer APIs, and unstructured image galleries.

Automotive Software, Electronics, and Data Markets: 2030 Outlook

According to McKinsey, the automotive software and electronics market is forecast to reach $462–469 billion by 2030, growing at a 5.5–7% CAGR—significantly outpacing the broader automotive market’s 1–3% growth range.

This shift is powered by the ACES megatrends—autonomous driving, connected cars, electrification, and shared mobility—which collectively fracture the traditional OEM-supplier model and elevate software as the industry’s next value frontier. Software development alone is projected to grow from $31B to $80B, with ADAS and AD stacks making up nearly 50% of that total.

Electronics control units (ECUs and DCUs) will remain the largest hardware segment, reaching $144B, while power electronics leads all categories with 23% CAGR, driven by EV acceleration. Simultaneously, the sensor market is set to double to $46B, fueled by Lidar, radar, and high-res camera demand for Levels 2–4 autonomy.

The real transformation, however, is structural: the centralization of E/E architectures and the decoupling of hardware from software are dissolving legacy silos. OEMs are forming cross-functional development teams and partnering across the stack—middleware to cloud—to contain exploding R&D costs.

Domain control units will dominate infotainment and autonomy by 2030, hitting 70%+ penetration, while Tier-1s must shift from component suppliers to integration partners. The winners will be those who treat the vehicle as a software-defined platform and can scale both agile engineering and regulatory-grade resilience.

At the same time, the automotive data analytics market is forecast to reach $10.5 billion by 2033, growing at a CAGR of 12.5%, while vehicle analytics are surging even faster—projected to jump from $4.27B in 2024 to $27.73B by 2032 (CAGR 26.3%).

But what exactly does automotive extraction entail, and why is it now central to operational strategy?

Extract Automobile Data: Structured vs. Unstructured

Automotive data comes in two dominant forms:

| Source Type | Examples | Extraction Method |

| Structured | Part catalogs, JSON APIs, VIN databases, listing specs | API scraping, field mapping |

| Unstructured | Photos, seller notes, embedded tables, video walkarounds | OCR, image classification, HTML parsing |

Knowing whether your target data is structured or unstructured shapes everything—your stack, your proxy setup, and your compliance risks.

A VIN field can be programmatically fetched. A photo of a cracked bumper, on the other hand, requires computer vision, OCR, and custom ML models to extract usable signals. Plan accordingly.

Latency, Compliance, and Localization: Hidden Frictions That Break Systems

Data extraction in automotive is never one-size-fits-all. Local laws shape what’s legal to collect. Latency tolerance depends on the use case—fleet pricing decisions may need hourly updates, while historical VIN tracebacks tolerate more delay. This sensitivity to latency and volume is why many firms choose to outsource data extraction to dedicated vendors with guaranteed uptimes.

More importantly, compliance isn’t a checklist. It’s architecture: how proxies rotate, how cookies persist, and how jurisdictional logic defines your infrastructure. What qualifies as “real-time” varies—German platforms may push hourly updates, while U.S. marketplaces often refresh every few hours.

Data Extraction Automotive: 3 Layers

Automotive platforms expose their data across three architectural surfaces:

1. Static HTML Listings

Old-school sites with plain markup. Easy to parse but may lack real-time data fidelity.

2. JS-Rendered Listings

Platforms like mobile.de or Truck1 rely on dynamic rendering. Requires headless browsers like Puppeteer or Playwright.

2. API-Based Catalogs

Used by modern part suppliers and marketplaces (e.g., Partly). Fast, scalable—but legally sensitive and often undocumented.

Scraping success depends on recognizing which layer you’re targeting—and why.

Why Automotive Data Extraction Is Now a Core Capability

Automotive businesses no longer compete on inventory alone—they compete on data velocity, accuracy, and integration. Whether parsing unstructured damage images for insurance models or syncing structured part specs to ERPs, extraction is the connective tissue between source data and operational insight. This specialized process often requires dedicated web scraping development services to build robust and scalable systems.

The rise of software-defined vehicles, real-time marketplaces, and autonomy-ready infrastructure means that your ability to extract, normalize, and act on multi-source automotive data isn’t a technical advantage—it’s a strategic necessity.

The companies that succeed will be those who treat data extraction not as a side process, but as an embedded layer in their business architecture—designed for compliance, built for scale, and ready for AI.

Quick Answers for Decision-Makers

For those making time-sensitive decisions—or briefing cross-functional teams—this section condenses the core insights of automotive extraction into four high-leverage questions. Each answer reflects engineering constraints, legal nuance, and expected ROI framing.

“Should we build our own automotive data scraper?”

No—unless you have a full DevOps + compliance team.

In-house scrapers break under three pressures: site variability, legal exposure, and cost of maintenance. The majority of firms end up with half-broken scripts or locked into opaque vendor systems with no control over parsing or scaling.

If you do build, start with a testbed of 2–3 platforms, then prototype your proxy + compliance logic before scaling.

“Which proxy type fits our use case and scale?”

| Use Case | Recommended Proxy Type | Why It Works |

| Marketplace listings | Shared Datacenter | Fast and cost-effective for static HTML content |

| Price monitoring (geo) | Rotating Residential | Enables geo-targeting, avoids common IP blocks |

| Image extraction | ISP | Offers persistent IPs and stable media delivery |

| Video scraping / 360 views | Mobile | Best for bypassing sessions and heavy CDN load |

Residential and mobile proxies offer better evasion, but carry higher legal and financial costs. Your proxy stack should evolve with your surface area. The constant need for high-trust, region-specific IPs in a data supply chain is why specialized services implement advanced how to make rotating proxies solutions.

“What ROI can we expect from automotive web data?”

If you’re tracking listings, prices, or part availability, ROI comes from:

- Faster pricing decisions → reduce days-on-market

- Fewer mislistings → better buyer conversion

- SKU alignment → margin protection

Firms typically see ROI within 2–4 months, depending on update frequency and SKU complexity.

“What risks should we plan for?”

| Risk Type | Description |

| Legal | TOS violations, GDPR conflicts, geo-IP compliance issues |

| Operational | IP blocks, markup drift, scraping detection or bans |

| Strategic | Vendor lock-in, data latency, overdependence on APIs |

Failing to account for these breaks in pipelines exposes legal attack surfaces. Embed compliance and modular proxying from day one.

Unlike most vendors that lock you into opaque APIs, fixed schemas, or non-portable pipelines, GroupBWT builds modular, transferable stacks. You retain full control over logic, hosting, and future vendor flexibility.

Who Needs Automotive Data —and What They Should Do Next

This guide is designed for decision-makers and engineers who are actively planning or improving data extraction for automotive use cases.

Whether you’re evaluating how to extract data in automotive settings, deploying a new pipeline to extract automobile web data, or looking to build a scalable automotive extraction data system, this content is structured for clarity, compliance, and ROI.

CTOs / Heads of Data Engineering

Why you’re here: You’re assessing proxy risk, architectural choices, and regulatory exposure in data extraction automotive environments.

Read this to:

- Compare proxy types by reliability, region, and legal status

- Choose between headless scraping, API access, or hybrid methods

- Validate your stack for traceability, audit logs, and long-term compliance

Marketplace & Automotive Founders

Why you’re here: You’re expanding into resale, listings, or fleet aggregation, and need resilient data extraction in automotive systems.

Read this to:

- Scope the cost of multi-source scraping across resale markets

- Detect stale, duplicated, or incomplete listings before buyers do

- Build a repeatable system to extract automobile data without vendor lock-in

BI / ML Engineers & Data Analysts

Why you’re here: You need labeled datasets, pricing histories, and visual classification pipelines from scraped vehicle data.

Read this to:

- Normalize listing specs, part compatibility, and VIN fields

- Train models using image/video from scraped sources

- Surface real-time buying signals and detect price anomalies

eCommerce Product Owners & Ops Leads

Why you’re here: You run catalogs or feeds and must adapt pricing and availability dynamically across SKUs and marketplaces.

Read this to:

- Extract auto parts data from external APIs and catalogs

- Connect feeds to pricing engines and inventory sync systems

- Operationalize data extraction for automotive without code debt

The reliance of e-commerce on competitive intelligence for pricing aligns this operation with core data scraping for ecommerce strategies

How to Extract Data for Automotive—By Use Case

Automotive platforms are rich in high-value public data, but not all of it is equally accessible or structured. A successful automotive extraction strategy must identify which fields are critical to your downstream goals: pricing, analytics, modeling, or feed enrichment.

Below, we break down the most important categories of extractable data, the typical format they appear in, and how they’re transformed into structured, usable records.

Vehicle Listings (Structured HTML or API)

Includes:

- Make, model, trim, variant

- Mileage, registration date, condition

- VIN (Vehicle Identification Number)

- Price, currency, tax status

- Listing date, update frequency

- Dealer or private seller ID

Use Case: Pricing intelligence, stock availability, market trend analysis

Output Format: Structured JSON, CSV, or DB schema with record-level granularity

Price History and Markdown Patterns

Includes:

- Historical pricing snapshots

- Delta analysis (price increases/decreases over time)

- Discounts, seasonal promotions, and demand-driven changes

Use Case: Dynamic repricing, deal prediction, market competitiveness monitoring

Output Format: Time-series data linked by listing ID

Auto Parts Catalogs (API / JavaScript-rendered)

Includes:

- SKU, brand, category, compatibility data

- Stock availability and expected delivery

- Fitment filters (make/model/year)

- Price per unit, bundles, discounts

- Supplier/vendor name

Use Case: eCommerce listing enrichment, inventory sync, compatibility mapping.g

Output Format: Normalized product schemas; API-ready JSON

Seller Metadata and Ratings

Includes:

- Seller type (dealer, private, verified)

- Rating scores, reviews, and response times

- Number of vehicles listed

- Geographic distribution of sellers

Use Case: Trust scoring, fraud detection, supplier benchmarking

Output Format: Nested objects (Seller ID → Ratings → Listings)

Images, Videos, and Visual Data

Includes:

- Photo galleries per vehicle (interior/exterior)

- Video walkarounds, 360° model views

- Image metadata (angles, features, timestamps)

- Embedded EXIF data (camera, location, etc.)

Use Case: ML training datasets, visual damage detection, feature identification

Output Format: Image URLs + labeled tags → ML-ready vector formats

Logistics & Availability Metadata

Includes:

- Delivery options, fleet tracking availability

- Pickup/return dates (for B2B platforms)

- Regional restrictions or jurisdictional info

- Payment terms and warranty duration

Use Case: Supply chain orchestration, compliance forecasting, cost modeling

Output Format: Structured fields linked to the marketplace API or listing records

Don’t scrape everything—scrape what your system can operationalize.

If you’re focused on pricing accuracy, prioritize VIN, condition, and markdown history.

If your goal is to train ML models, focus on image extraction and labeled attributes.

For catalog enrichment, extract parts data, fitment tags, and inventory snapshots.

Proxy Infrastructure Explained: Scale Without Getting Blocked

Understanding how proxy types interact with automotive scraping layers is essential for uninterrupted access, legal stability, and operational cost control.

Proxy Infrastructure Explained: Scale Without Getting Blocked

| Proxy Type | Best Use Cases & Pros | Risks / Tradeoffs |

| Datacenter | Structured listings, fast, cheap, scalable | Easily blocked, fingerprinted |

| Residential | Geo-targeted price tracking, high trust | Slower, costly, legal gray zones |

| ISP | CDN scraping, persistent IPs, high success rate | Rare, expensive, subject to ISP restrictions |

| Mobile | Multimedia scraping, CAPTCHA evasion, session flows | High latency, limited IP pool, legal exposure |

Proxy Mechanisms: Rotating, Sticky, Session-Based

Understanding proxy mechanics isn’t optional—it’s what keeps your scraper from collapsing under rate limits, session loss, or fingerprint bans.

- Rotating Proxies: Use a new IP per request or session. Ideal for scraping large datasets anonymously.

Use when: Pulling unstructured data across multiple sources with low dependency on cookies. - Sticky Proxies: Maintain the same IP for a defined period (10s–10min).

Use when: Accessing paginated listings or login-protected dashboards requiring session continuity. - Session-Based Proxies: Advanced configuration allowing precise session mapping.

Use when: Extracting listings that rely on shopping cart logic, user-specific filters, or CDN-based content delivery.

Which Proxy for Which Use Case?

If you’re wondering how to make rotating proxies, understanding their core function is the first step.

| Use Case | Proxy Type | Why It Works |

| Static listings | Datacenter | Fast, low-cost, handles markup |

| Cross-country monitoring | Residential | Geo-targeting, avoids IP bans |

| Image/video scraping | Mobile / ISP | Bypasses CDN, evades fingerprints |

| Dealer stock tracking | Residential / ISP | Stable sessions, fewer login issues |

| API parsing | Datacenter / Residential | Sticky IPs, respects rate limits |

Strategic Takeaway

You don’t just “choose” a proxy. You engineer a proxy strategy. The right combination must account for:

- Surface type (HTML, JS, API)

- Expected volume (requests per minute/hour/day)

- Geo-coverage requirements

- Legal exposure by jurisdiction

And critically, how your proxies integrate into:

- Session control logic

- Retry/backoff mechanisms

- Compliance observability (e.g., logging, audit flags)

Scraper Architecture Options: Visual Decision Framework

Every automotive data pipeline must survive real-world pressure: site changes, proxy blocks, CAPTCHAs, and legal boundaries.

Below are the three most effective scraper setups, sorted by scale, cost, and risk tolerance, designed to help you pick what fits your data extraction automotive use case.

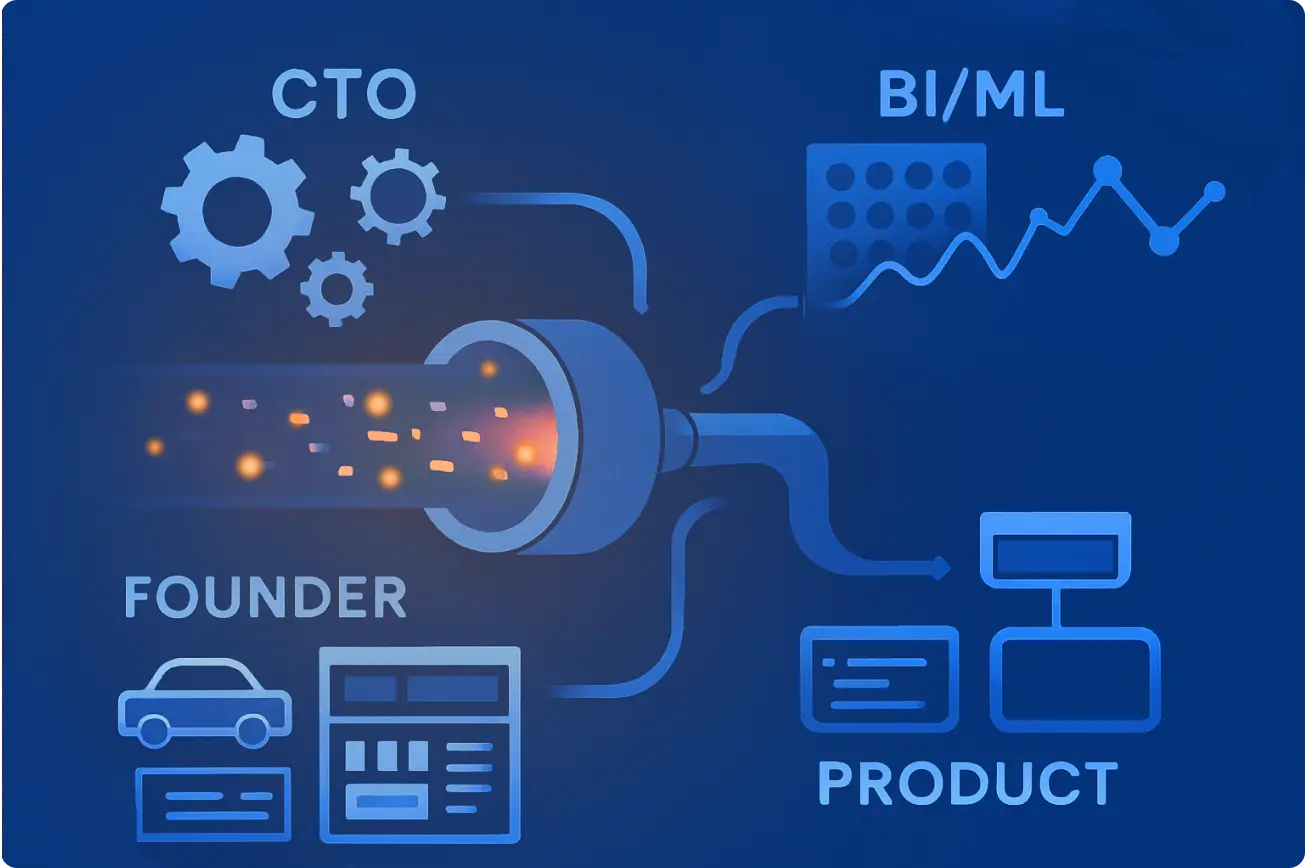

Tiered Architecture Models

| Level | Name | Best For |

| 1 | Lite Tracker | MVPs, pilot tests |

| 2 | Anti-Bot Engine | eCommerce, fintech scraping |

| 3 | AI Mesh System | OEMs, video data, global ops |

Infrastructure Components by Proxy Type

| Component | Proxy Type | Stack & Cost |

| Lite Tracker | Datacenter | Python + Requests / 💲 Low |

| Anti-Bot Engine | Residential (Rotating) | Scrapy + Proxy API / 💲💲 Medium |

| AI Mesh System | ISP / Mobile + CDN | Puppeteer + OCR + ML / 💲💲💲 High |

When to Use Each Setup

1. Lite Tracker

(Datacenter, Static Only)

- Simple setup for static sites (e.g., plain HTML)

- No JS or session management

- Ideal for short-term projects or validation work

→ Use it if: You’re testing a market or need fast results with minimal setup.

2. Anti-Bot Engine

(JS-ready, Rotating Proxies)

- Handles most dynamic marketplaces (like Autotrader)

- Built-in evasion for moderate anti-bot defenses

- Faster than browser automation

→ Use it if: You need moderate-scale scraping, especially for structured data like price feeds or part SKUs.

3. AI Mesh System

(Full JS + Media + Compliance)

- For global-scale or regulated pipelines

- Includes image extraction, OCR, and geo-aware proxies

- Can scrape video walkarounds, extract VIN from photos, and log sessions for compliance

→ Use it if: You need long-term, high-volume scraping with ML training data or legal safeguards.

Modular Stack Blueprint (Simplified)

| Layer | Function | Examples |

| Control | Job timing + retries | Airflow, Node-cron |

| Engine | Scraping (API or headless) | Playwright, Requests |

| Proxies | Evasion + geo-routing | Bright Data, Smartproxy |

| Compliance | Cookie consent + logging | Custom middleware, headers |

| Output | Format + push to pipeline | Pandas, JSON, SQL, Kafka |

Match Your Goal to the Right Setup

| Goal | Use This Setup | Why It Works |

| Scrape static listings (VINs) | Lite Tracker | Fast, simple, low-cost |

| Extract photos, videos, PDFs | AI Mesh System | JS + visual scraping + OCR |

| Track regional price trends | Anti-Bot Engine | Rotates IPs, stable parsing |

| Build datasets for ML training | AI Mesh System | Legal traceability + media tags |

| Feed data to ERP/CRM | Anti-Bot or API-first | Reliable, structured integration |

How to Handle Video and Image Data at Scale

(Supports: ML training, visual validation, parts detection)

Visual data powers key automotive decisions—from verifying condition to training classification models. But scaling it requires both the right tools and structured output.

Tools You’ll Need

| Purpose | Recommended Tools | Notes |

| Headless scraping | Puppeteer / Selenium | Needed for JS-rendered galleries, video pages |

| Media parsing | ffmpeg | Extracts frames, compresses for ML workflows |

| Metadata extraction | EXIF tools / Python PIL | Pulls angles, timestamps, geo-tags |

Common Use Cases

| Use Case | Data Type | Business Outcome |

| Interior/exterior check | Photos, videos | Validate listings, prevent mislabeling |

| Model recognition | Multi-angle images | Enable real-time detection and auto-sorting |

| 360° walkthroughs | MP4 / WebM video | Train ML for condition and feature analysis |

Schema Overview: From Media to ML

| Dataset Type | Media Format | Usage Example |

| Labeled car galleries | JPEG + tags | Damage detection, variant classification |

| Video frame sets | MP4 → PNGs | Angle-specific model training |

| Metadata + visual | EXIF + image | Trust scoring, fraud detection |

Tip: Always decouple the scraper from the parser.

Pipeline Logic: Decouple for Flexibility

| Stage | Component | Purpose |

| Data Collection | Scraper (e.g. Puppeteer) | Capture raw multimedia content |

| Data Parsing | Parser (e.g. ffmpeg, PIL) | Extract frames, tags, metadata |

| Data Labeling | Manual / ML Tagger | Annotate images or videos for ML training |

| Dataset Assembly | File System / Cloud Store | Organize by type, label, timestamp, and angle |

| Reuse & Training | ML Engine (e.g. YOLO, OpenCV) | Enable multi-purpose model pipelines |

Let your visual data pipeline remain modular—scrape once, then reuse the output for different ML or catalog objectives.

Read our guide on Why Extract Data from Video & Multimedia Sources in 2025 to get more info right away.

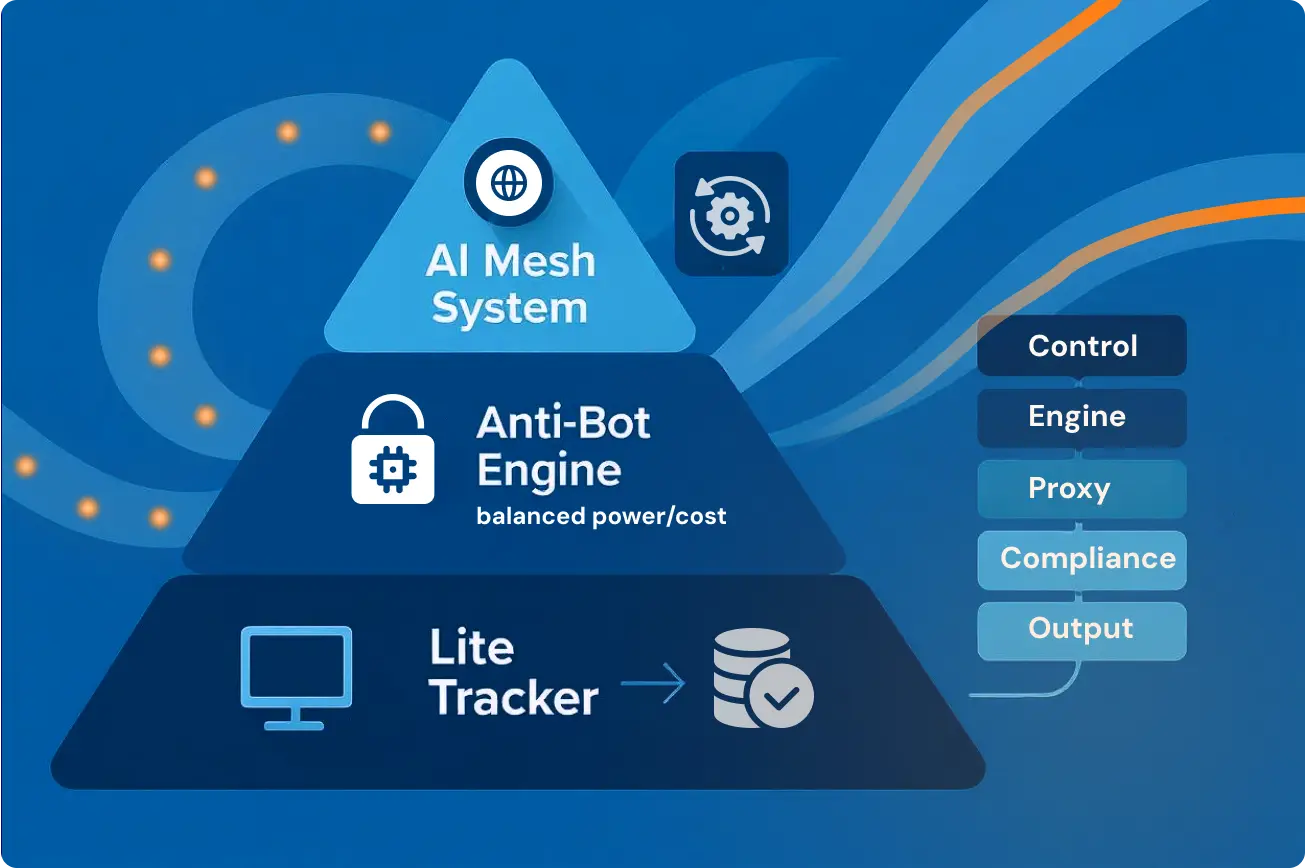

Legal, Ethical, and Compliance Risks (With Heatmap)

Automotive web data extraction sits at the crossroads of innovation and legal exposure. Whether you’re extracting VINs, prices, or images, your risk profile changes by region, data type, and method of access.

Key Legal Dimensions You Must Evaluate

| Topic | Risk Area | Action Required |

| Terms of Service | Scraping violations | Review policies before targeting platforms |

| GDPR / CCPA | Data handling & privacy | Add opt-outs, anonymize logs, set headers |

| IP Jurisdiction | Cross-border legal exposure | Use geo-aligned proxies |

| Robots.txt | Legal ambiguity by region | Treat as enforceable in EU, advisory in U.S. |

GDPR / CCPA Compliance Checklist

Before you scrape any user-related or session-based data, confirm:

- No personal identifiers are extracted (emails, phones, user IDs)

- Logs are anonymized and rotate IPs per session

- Consent flags were respected where required

- Your DPO/legal team has documented rationale (if challenged)

Global Friction Zones for Automotive Scraping

| Region | Compliance Friction | Notes |

| United States | Low | TOS-based; robots.txt = advisory |

| Germany / France | Medium | GDPR applies; bots scrutinized |

| UK / Nordics | Low | GDPR-lite enforcement; case-by-case |

| India / Brazil | High | Legal ambiguity + ISP-level blocks |

| China / UAE | High | Strict data sovereignty laws |

How to Reduce Exposure

- Use rotating proxies aligned to local data laws

- Avoid scraping personal seller data unless explicitly permitted

- Maintain full logs of scraping decisions and logic

- Include opt-out mechanisms where applicable

Real-World Failure Scenarios—and How to Fix Them

When scraping automotive platforms at scale, fragility hides in plain sight: a blank page, a frozen loop, or an HTTP 403. Below are the most common failure patterns and proven, scalable fixes.

Issue Matrix: What Breaks, Why, and What to Do

| Failure Type | Root Cause | Remediation Strategy |

| CAPTCHA Loop | IP reputation or velocity triggers | Use CAPTCHA solver + delays + user-agent rotation |

| Blank Page / Timeout | JS-rendered content blocks static | Use Puppeteer with waitForSelector() + screenshot validation |

| Blocked at CDN | Device fingerprinting mismatch | Rotate headers, TLS, use ISP/mobile proxies |

| Broken Image Paths | Lazy loading or CDN gating | Scroll simulation + parse |

| Session Expired | Missing cookies/session binding | Use persistent sessions or cookieStore |

| Unstable Pagination | Dynamic URLs or scroll-based loaders | Detect XHR calls, simulate AJAX or use API endpoints |

Automotive Data Extraction: Market Cost Calculator

Before launching any automotive extraction initiative, it’s critical to understand the cost-performance tradeoffs across infrastructure, update frequency, and proxy strategy.

This calculator table gives your team a transparent view into how variables like listing depth, geographic spread, and compliance requirements affect your operational costs and revenue outcomes.

| Input Variable | Your Value (Example) | Impact on Cost / ROI |

| Platforms Scraped | 8 platforms | More platforms = higher complexity, proxy load, and session handling |

| Update Frequency | Every 6 hours | Increases IP usage, retry rate, and bandwidth costs |

| Data Points per Listing | 15 fields (VIN, price, img) | More logic per record, may trigger visual scraping & parsing overhead |

| Regions Covered | EU + US | Requires geo-rotating proxies to avoid blocks and maintain session flow |

| Proxy Type Used | Residential + Mobile | Higher cost but best for evasion and dynamic content access |

| Visual Data Extracted? | Yes – 360° + photos | Adds headless browser load, CDN strain, video frame parsing |

| Structured Output? | JSON + DB sync | Requires schema enforcement, transformation pipeline, DB sync layer |

ROI Summary (Example)

| Metric | Value | Notes |

| Time-to-Break-Even | 2.1 months | ROI achieved quickly with proper proxy rotation |

| Monthly Infra Cost | $2,500–$4,200 | Varies by update rate, proxy type, and data volume |

| Revenue Lift | +11.4% margin | Driven by better pricing insights and accuracy |

| Revenue Lift | Mitigated | Compliance, proxy governance, and audit-ready logs |

Most enterprise automotive scraping projects fail due to underestimated infrastructure costs or oversimplified ROI models. This calculator gives your product, ops, and finance teams a shared planning tool to validate budgets and prioritize features before the first line of code is written.

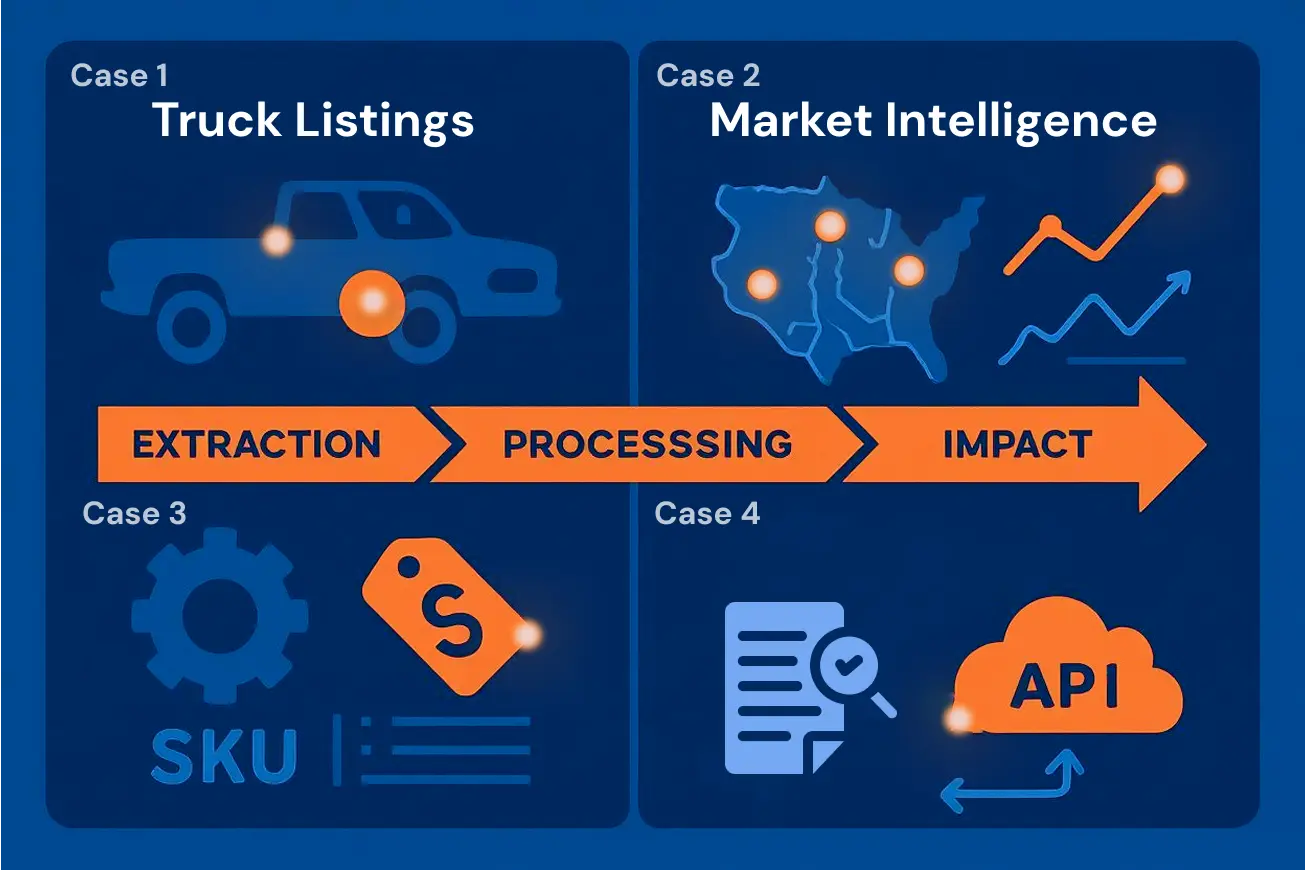

Automotive Data Extraction in Action: 4 GroupBWT Case

Case 1 – Extracting Truck Listings with Visual Damage Detectio

Client Problem:

Couldn’t track used truck prices or detect visual indicators (e.g., damage, upgrades) across 12 resale platforms in real time.

Solution:

- Live outsource data extraction from leading European marketplaces

- Automated photo flagging for collision and refrigeration units

- Admin dashboard for query-based export and filtering

Impact:

- Time-to-sale reduced by 3.7 days per truck

- 18% increase in price accuracy across SKUs

Case 2 – Resale Market Intelligence at Scale

Client Problem:

Needed to monitor millions of automotive listings to uncover buyer demand trends and vehicle depreciation rates.

Solution:

- Headless web scraping development services with anti-blocking rotation

- Parsing of structured fields: VIN, mileage, region, seller ID

- Behavioral metadata enrichment

Impact:

- 90 %+ live listing coverage across 8 countries

- Insights now power quarterly OEM trend reports

Case 3 – Competitor Pricing Engine for Auto Parts

Client Problem:

No visibility into competitor pricing on fast-moving aftermarket parts.

Solution:

- Filter-based scraping of competitor catalogs

- JSON feed with real-time SKU pricing deltas

- Plug-in ready for pricing strategy engine

Impact:

- Found a 12.4% margin gap on key SKUs

- Achieved 9.2% margin growth in 6 months

Case 4 – Structured Catalog Ingestion from Shopify & APIs

Client Problem:

Needed full part compatibility, pricing, and fitment data from 30+ external brands using third-party APIs and dynamic Shopify pages.

Solution:

- Hybrid scraper: sitemap → product JSON → external API

- Field-level normalization of fitment and interchangeability

- Output delivered as weekly JSON feed or cold storage DB

Impact:

- 98.2% product coverage achieved during PoC

- Enabled automated, weekly ingestion without manual checks

Book a 30-Minute Strategy Session

From resale monitoring to part fitment extraction, these cases show what matters most: accuracy, resilience, and compliance at scale. Whether your goal is faster time-to-market, tighter price controls, or real-time listing intelligence, the system must work, not just scrape.

GroupBWT builds custom, production-grade data pipelines for automotive. No vendor lock-in. No brittle scripts. No risk to your infrastructure or brand reputation.

If you’re dealing with unreliable scraping, slow data updates, or mounting compliance risks, we can help.

Book a free consultation with our technical team to:

- Evaluate your current scraping setup

- Uncover cost or risk blind spots

- Scope a custom pipeline that fits your business model

We’ve done it for top automotive players—under NDA, on time, and at scale. Let’s build yours.

FAQ

-

How to extract cars data from unstructured sources?

Unstructured automotive data—like photos, video walkarounds, or seller notes—requires a visual parsing stack. This includes headless browsers (e.g., Puppeteer), OCR tools, and media classifiers. You won’t get usable results from basic scrapers. To extract cars data at scale, deploy a modular system that separates rendering, parsing, and tagging into distinct jobs.

-

What’s the best method to extract data for automotive marketplaces?

Structured fields—like VIN, price, and condition—can be extracted using HTML parsers or marketplace APIs. But marketplaces with dynamic rendering (e.g., JavaScript-based platforms) demand browser automation and proxy rotation. To extract data for automotive resale with high uptime, combine headless scraping with a rotating proxy pool tuned to regional IPs.

-

How to extract data in automotive industry without legal risks?

Start by mapping your data sources to their risk level. Avoid scraping user-generated content or PII. Use GDPR-compliant proxy infrastructure, rotate IPs by jurisdiction, and respect robots.txt in EU regions. For compliance-first data extraction in automotive, your pipeline must include anonymization, consent logic, and logging at every layer.

-

What tools are used to extract automobile data for ML or analytics?

If your use case involves training ML models or generating dashboards, you’ll need structured output—JSON, CSV, or DB schema. Use a combination of:

- API scraping for parts catalogs

- Visual scraping for photos and damage markers

- VIN resolution services for enriched records

To extract automobile data that feeds ML or BI tools, every record must be complete, normalized, and timestamped.

-

Who should own the project to extract data in automotive systems?

Ownership depends on your goal. If you’re enriching catalogs, the eCommerce or product ops team should lead. For analytics or fleet pricing, it’s BI or data engineering. But all teams must coordinate with legal to ensure compliant implementation.

To extract data in automotive systems without delays or misfires, assign:- Technical owner: Defines scraping logic and architecture

- Compliance lead: Flags legal boundaries per region/source

- Business sponsor: Connects outputs to pricing, stocking, or ML goals

Cross-functional ownership avoids scope creep, legal blind spots, and brittle deployments.